https://sputniknews.in/20230222/india-singapore-link-online-payment-systems-for-real-time-cross-border-payment-959923.html

India, Singapore Link Online Payment Systems for Real-Time Cross Border Payment

India, Singapore Link Online Payment Systems for Real-Time Cross Border Payment

Sputnik India

India and Singapore on Tuesday launched a real-time payment digital method to enable faster remittance between the two countries.

2023-02-22T00:17+0530

2023-02-22T00:17+0530

2023-02-22T00:17+0530

india

singapore

payment mechanism

mir (payment system)

g-20

narendra modi

trade in national currencies

https://cdn1.img.sputniknews.in/img/07e7/02/15/962760_318:0:1730:794_1920x0_80_0_0_7f6ebc7d9fa13ac11e27b0e17ffe08e9.jpg

India and Singapore on Tuesday launched a real-time digital payment method to enable faster remittances between the two countries.From now on, India's real-time customer, or retail payment system, Unified Payments Interface (UPI), will allow digital payment through its equivalent network in Singapore, PayNow, in real time to facilitate easier cross-border money transfers at a competitive rate.Indian Central Bank Governor Shaktikanta Das initiated the first transaction with his counterpart Managing Director Ravi Menon, according to a statement issued by the Monetary Authority of Singapore on Tuesday.Per 2021 data, almost 700,000 Indians live or work in Singapore, which includes students and migrant workers too.All You Need to Know About Linkage Between UPI and PayNowIndia Boosting Digital PaymentsToday, India's announcement is seen as a continuation of New Delhi's ongoing effort to expand its tech infrastructure in digital payments with other nations. As India is also hosting the G20 this year, it is continuously speaking with other nations on digital payment involving the respective country's central bank.Although Singapore is not a G20 member, it has been invited to participate at the G20 Summit this year.

https://sputniknews.in/20230207/toppling-dollar-hegemony-india-may-lead-by-example-in-global-south-783331.html

india

singapore

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Deexa Khanduri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138923_52:0:533:481_100x100_80_0_0_cadf23d341691fc65ff2b22fd1afe584.jpg

Deexa Khanduri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138923_52:0:533:481_100x100_80_0_0_cadf23d341691fc65ff2b22fd1afe584.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Deexa Khanduri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138923_52:0:533:481_100x100_80_0_0_cadf23d341691fc65ff2b22fd1afe584.jpg

india and singapore launch real-time payment digital method, unified payments interface (upi), paynow, singapore prime minister lee hsien loong, shaktikanta das, ravi menon, monetary authority of singapore, mas, dbs holding group, axis bank ltd., dbs india, icici bank ltd., indian bank, indian overseas bank, state bank of india, india and singapore digital payment

india and singapore launch real-time payment digital method, unified payments interface (upi), paynow, singapore prime minister lee hsien loong, shaktikanta das, ravi menon, monetary authority of singapore, mas, dbs holding group, axis bank ltd., dbs india, icici bank ltd., indian bank, indian overseas bank, state bank of india, india and singapore digital payment

India, Singapore Link Online Payment Systems for Real-Time Cross Border Payment

Deexa Khanduri

Sputnik correspondent

Of the total inward remittances to India in 2020-21, the share of Singapore stood at 5.7 percent, and 6 percent in 2021-22, according to the RBI Remittance Survey.

India and Singapore on Tuesday launched a real-time digital payment method to enable faster remittances between the two countries.

From now on, India's real-time customer, or retail payment system, Unified Payments Interface (UPI), will allow digital payment through its equivalent network in Singapore, PayNow, in real time to facilitate easier cross-border money transfers at a competitive rate.

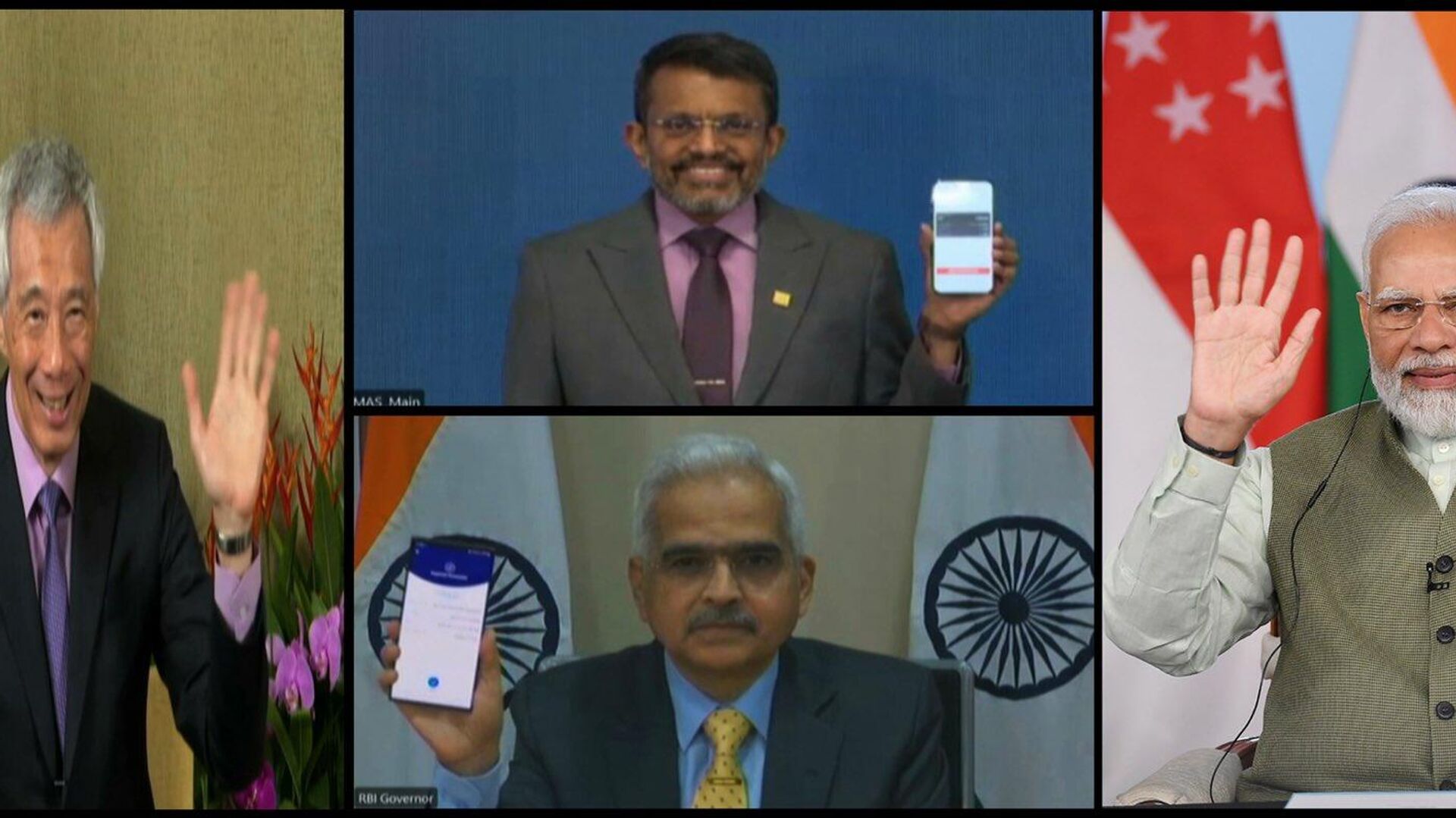

"This will enable people from both the countries to immediately and at low-cost transfer funds (by) just using their mobile phones," Indian Prime Minister Narendra Modi said at a virtual event also attended by Singapore's Prime Minister Lee Hsien Loong.

Indian Central Bank Governor Shaktikanta Das initiated the first transaction with his counterpart Managing Director Ravi Menon, according to a statement issued by the Monetary Authority of Singapore on Tuesday.

Per 2021 data, almost 700,000 Indians live or work in Singapore, which includes students and migrant workers too.

All You Need to Know About Linkage Between UPI and PayNow

According to a statement released by MAS, DBS Holding Group and a non-bank financial institution, Liquid Group, are participating from Singapore in the tie-up.

The Indian banks participating in the linkage are Axis Bank Ltd., DBS India, ICICI Bank Ltd., Indian Bank, Indian Overseas Bank, and State Bank of India.

As a start, selective customers of Singapore's largest bank can use the so-called PayNow-UPI linkage to transfer funds of as much as S$200 (US $150) per transaction, capped at S$500 a day.

The service will be extended to all customers by March 31, and they can transfer funds of as much as S$1,000 a day.

The new system is expected to bring down the cost of sending remittances by as much as 10 percent.

India Boosting Digital Payments

Today, India's announcement is seen as a continuation of New Delhi's ongoing effort to expand its tech infrastructure in digital payments with other nations.

As India is also hosting the G20 this year, it is continuously speaking with other nations on digital payment involving the respective country's central bank.

Although Singapore is not a G20 member, it has been invited to participate at the G20 Summit this year.