https://sputniknews.in/20240307/imf-pushes-pakistan-to-raise-taxes-to-obtain-more-loans-amid-grim-economic-outlook-6766654.html

IMF Pushes Pakistan to Raise Taxes to Obtain More Loans Amid Grim Economic Outlook

IMF Pushes Pakistan to Raise Taxes to Obtain More Loans Amid Grim Economic Outlook

Sputnik India

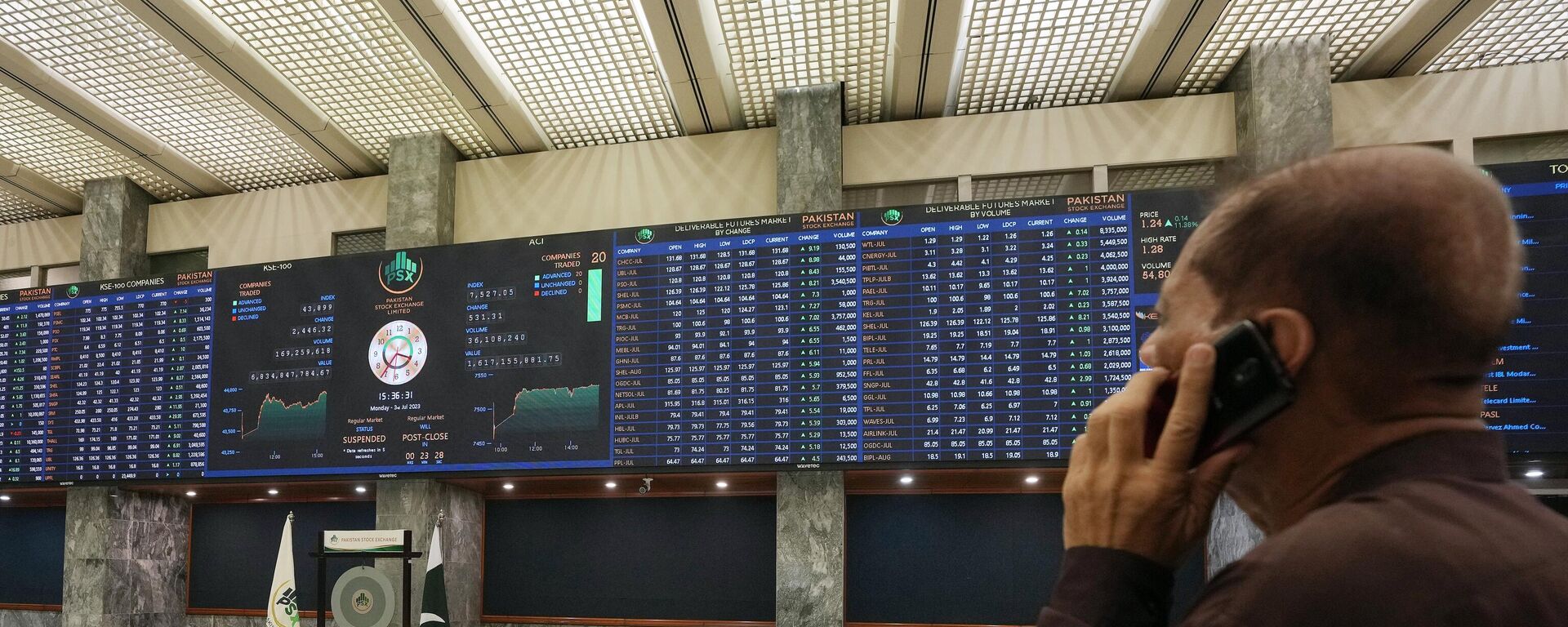

As Pakistan struggles past its controversial elections, political chaos is threatening to affect its $3 billion deal with the International Monetary Fund (IMF) amid rising concerns of potential economic default.

2024-03-07T19:15+0530

2024-03-07T19:15+0530

2024-03-07T19:15+0530

imran khan

shehbaz sharif

pakistan

india

china

imf loan

economic crisis

economic challenges

debt restructuring

https://cdn1.img.sputniknews.in/img/07e8/03/04/6739623_0:160:3072:1888_1920x0_80_0_0_b5c4b25203316dedccfe277518413d14.jpg

Pakistan's new Prime Minister Shehbaz Sharif tasked his team to prepare an action plan to aid the country’s economy by proceeding with talks on an Extended Fund Facility (EFF) with the International Monetary Fund (IMF) earlier this week.He directed talks with the IMF regarding its Extended Fund Facility to begin immediately as Pakistan scrambles to avoid a macroeconomic crisis by securing a long-term bailout program with the Washington-based lender.The development comes at a time when Julie Kozak, head of the IMF's communications department, said that she looks forward to “working with the new government on policies to ensure prosperity and macroeconomic stability for all citizens of Pakistan."However, this news did not go down well with all political leaders, with former prime minister Imran Khan, founder of the Pakistan Tehreek-e-Insaf (PTI) party, writing to the IMF and urging it to conduct an audit of the election results before approving any fresh loan for Islamabad.Talking to the local media from Adiala Jail, Khan said that if the country receives a loan under such circumstances, who will bear the responsibility of repayment in the future?IMF Rules Narrow Path of Economic RecoverySputnik spoke with a former unit head at Engro Corporation and political observer, Dr. Shahid Rashid, who explained why committing to IMF rules narrows the path to economic recovery for countries like Pakistan.He further said that such structural reforms often lead to social unrest and have a negative impact on public welfare.Long Term Economic VulnerabilityMany Pakistani analysts and researchers believe that Pakistan met the required conditions of the IMF demand last year, including a record-high 21% policy rate and huge cut on imports that practically crumbled the economy. Pakistanis paid a heavy price for these moves, with 38% inflation and the loss of millions of jobs.Speaking to Sputnik, Javed Sheikh, a Lahore-based financial advisor to a development project, said that there's a risk of accumulating more debt with IMF programs for Pakistan.Pakistan is expected to repay $77.5 billion in foreign debt between April 2023 and June 2026.This amount is to be paid not only to the IMF but also to other major lenders of Pakistan's economy, such as Chinese financial institutions, private creditors and Saudi Arabia.But while China has lent billions to Pakistan, it has not dictated any particular economic model or policy changes to Pakistan.Last month, it was reported that Pakistan would seek a loan package from the IMF plus $1.5 billion in climate finance. The new government is now opting for the possibility of increasing the program to $7.5-8 billion, with the addition of climate finance in the next bailout package.

https://sputniknews.in/20230725/pm-says-imf-steamrolled-pakistan-into-power-price-hikes---3160628.html

pakistan

india

china

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

imran khan, shehbaz sharif, pakistan, india, china, imf loan, economic crisis, economic challenges, debt restructuring

imran khan, shehbaz sharif, pakistan, india, china, imf loan, economic crisis, economic challenges, debt restructuring

IMF Pushes Pakistan to Raise Taxes to Obtain More Loans Amid Grim Economic Outlook

As Pakistan struggles past its controversial elections, political chaos is threatening to affect its $3 billion deal with the International Monetary Fund (IMF) amid rising concerns of potential economic default.

Pakistan's new Prime Minister

Shehbaz Sharif tasked his team to prepare an action plan to aid the country’s economy by proceeding with talks on an Extended Fund Facility (EFF) with the

International Monetary Fund (IMF) earlier this week.

The premier conducted a meeting in which he asked authorities to come up with a plan to revive Pakistan’s economy. "We have got the mandate to improve the economy and this is the top priority of our government," Sharif was quoted by Pakistani media as saying.

He directed talks with the IMF regarding its Extended Fund Facility to begin immediately as Pakistan scrambles to avoid a

macroeconomic crisis by securing a long-term bailout program with the Washington-based lender.

The development comes at a time when Julie Kozak, head of the IMF's communications department, said that she looks forward to “working with the new government on policies to ensure prosperity and macroeconomic stability for all citizens of Pakistan."

However, this news did not go down well with all political leaders, with former prime minister

Imran Khan, founder of the Pakistan Tehreek-e-Insaf (PTI) party, writing to the IMF and urging it to conduct an audit of the election results before approving any fresh loan for Islamabad.

Talking to the local media from Adiala Jail, Khan said that if the country receives a loan under such circumstances, who will bear the responsibility of repayment in the future?

IMF Rules Narrow Path of Economic Recovery

Sputnik spoke with a former unit head at Engro Corporation and political observer, Dr. Shahid Rashid, who explained why committing to IMF rules narrows the path to economic recovery for countries like Pakistan.

"Pakistan signed a nine-month standby agreement with the IMF last year. It will expire early next month, and securing another long-term plan is seen as a priority for this government. But it must be understood that when the IMF agrees to lend money to a developing country like Pakistan, it demands major structural reforms," Rashid explained.

He further said that such structural reforms often lead to social unrest and have a negative impact on public welfare.

"Currently there is a 30% inflation rate across the country and millions of people are struggling. The IMF's tight loan conditions reduce economic growth, deepen and prolong financial crises, and create hardship for the poorest people in the country. Recently, the IMF has told the government of Pakistan to implement an 18 percent general sales tax (GST) on food, medicine, petroleum products, and stationery. That means a further burden on the common man," the observer noted.

Long Term Economic Vulnerability

Many Pakistani analysts and researchers believe that Pakistan met the required conditions of the IMF demand last year, including a record-high 21% policy rate and huge cut on imports that practically crumbled the economy. Pakistanis paid a heavy price for these moves, with 38% inflation and the loss of millions of jobs.

Speaking to Sputnik, Javed Sheikh, a Lahore-based financial advisor to a development project, said that there's a risk of accumulating more debt with IMF programs for Pakistan.

"While the immediate financial relief is crucial, the country needs to carefully manage its debt to avoid long-term economic vulnerabilities. The IMF becomes a bandaid rather than a cure," Sheikh said.

Pakistan is expected to repay $77.5 billion in foreign debt between April 2023 and June 2026.

This amount is to be paid not only to the IMF but also to other major lenders of Pakistan's economy, such as Chinese financial institutions, private creditors and Saudi Arabia.

But while

China has lent billions to Pakistan, it has not dictated any particular economic model or policy changes to Pakistan.

Last month, it was reported that Pakistan would seek a loan package from the IMF plus $1.5 billion in climate finance. The new government is now opting for the possibility of increasing the program to $7.5-8 billion, with the addition of climate finance in the next bailout package.