https://sputniknews.in/20230222/all-you-need-to-know-about-new-property-taxes-in-jammu-and-kashmir-971971.html

All You Need to Know About New Property Taxes in Jammu and Kashmir

All You Need to Know About New Property Taxes in Jammu and Kashmir

Sputnik India

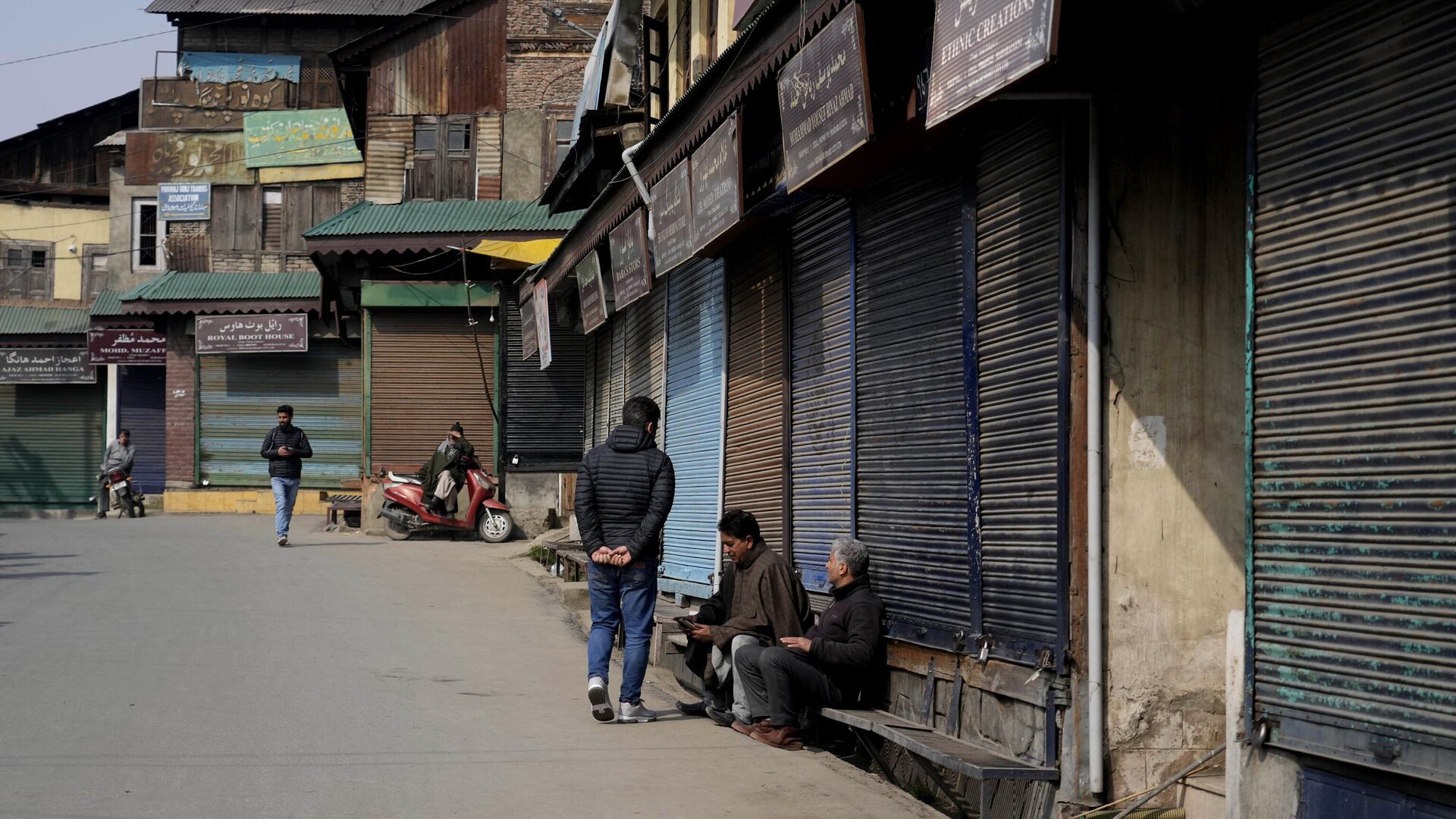

The authorities in Jammu and Kashmir on Tuesday introduced new property tax on the residents from April 1, 2023, a decision political parties are demanding to be withdrawn.

2023-02-22T19:20+0530

2023-02-22T19:20+0530

2023-02-22T19:20+0530

jammu and kashmir (j&k)

india

bharatiya janata party (bjp)

property tax

https://cdn1.img.sputniknews.in/img/07e7/02/16/975725_0:160:3073:1888_1920x0_80_0_0_059a377c85b2bd5e8c5c5db041da51ad.jpg

The Jammu and Kashmir administration on Tuesday introduced a new tax for property owners, expected to come into effect from April 2023. This is the first time property owners - both residential and commercial - will have to pay property tax in the region.The order announcing the changes in financial law has evoked criticism from local political parties, with politicians demanding this tax be repealed. Local Parties Object To New Property TaxesThe National Conference (NC) party, said in a statement that the administrative order made in the absence of an elected (state) government is anti-democratic and “smacks of arbitrariness”.The Jammu and Kashmir is at present ruled federally as a union territory and headed by a Lieutenant Governor. The last elections held for the legislative assembly here were in 2015. The coalition government of the region's People's Democratic Party (PDP) ,and the Bharatiya Janata Party (BJP) was brought to an end because of their differences in 2018.He also said that the lockdown imposed after the revocation of J&K’s semi-autonomous status in 2019 followed by the COVID-19 pandemic-induced lockdowns in 2020 and 2021, caused massive losses to local people in the region.“Imposition of the property tax will further push the people to the wall. Such decisions will make the situation even worse,” Dar said in a statement.The Mayor and Deputy Mayor of J&K’s summer capital Srinagar also opposed the move, stating they will not give “consent” to the imposition of the property tax.J&K Administration Clarifies New TaxIn the wake of all this criticism, the Jammu and Kashmir administration has issued a clarification stating there has been a degree of confusion because of “factually incorrect and misleading information”.The administration also said that local municipal bodies are not able to deliver because of poor finances, and that the tax is being levied to strengthen bodies to improve urban development for the betterment of the inhabitants.“This new property tax policy will help municipal bodies to generate revenue for better municipal services with minimum tax implications to residents,” the statement read.

jammu and kashmir (j&k)

india

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Azaan Javaid

https://cdn1.img.sputniknews.in/img/07e6/0c/08/19280_0:0:1080:1080_100x100_80_0_0_d0f3f10ac6f30fb5b9e5e21a5e2536ea.jpg

Azaan Javaid

https://cdn1.img.sputniknews.in/img/07e6/0c/08/19280_0:0:1080:1080_100x100_80_0_0_d0f3f10ac6f30fb5b9e5e21a5e2536ea.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Azaan Javaid

https://cdn1.img.sputniknews.in/img/07e6/0c/08/19280_0:0:1080:1080_100x100_80_0_0_d0f3f10ac6f30fb5b9e5e21a5e2536ea.jpg

new property tax in jammu and kashmir, political parties demand government order be withdrawn, local administration issues clarification, local administration says property tax a world norm

new property tax in jammu and kashmir, political parties demand government order be withdrawn, local administration issues clarification, local administration says property tax a world norm

All You Need to Know About New Property Taxes in Jammu and Kashmir

A row over new property taxes erupted in Jammu and Kashmir during a major clearance drive, aimed at evicting individuals accused of unlawfully encroaching on state land.

The Jammu and Kashmir administration on Tuesday introduced a new tax for property owners, expected to come into effect from April 2023.

This is the first time property owners - both residential and commercial - will have to pay property tax in the region.

The order announcing the changes in financial law has evoked criticism from local political parties, with politicians demanding this tax be repealed.

The order states that the J&K administration has “unveiled rules for levying, assessment and collection of property tax in the limits of municipal councils and committees of the union territory as the Housing and Urban Development Department”. They have notified the rules as “The Jammu and Kashmir Property Tax (Other Municipalities) Rules, 2023.”

Local Parties Object To New Property Taxes

The National Conference (NC) party, said in a statement that the administrative order made in the absence of an elected (state) government is anti-democratic and “smacks of arbitrariness”.

The Jammu and Kashmir is at present ruled federally as a union territory and headed by a Lieutenant Governor.

The last elections held for the legislative assembly here were in 2015. The coalition government of the region's People's Democratic Party (PDP) ,and the Bharatiya Janata Party (BJP) was brought to an end because of their differences in 2018.

“Unfortunately, such important issues don’t face public scrutiny in the current bureaucratic set up,” NC spokesman Imran Dar, said.

He also said that the lockdown imposed after the revocation of J&K’s semi-autonomous status in 2019 followed by the COVID-19 pandemic-induced lockdowns in 2020 and 2021, caused massive losses to local people in the region.

“Imposition of the property tax will further push the people to the wall. Such decisions will make the situation even worse,” Dar said in a statement.

The Mayor and Deputy Mayor of J&K’s summer capital Srinagar also opposed the move, stating they will not give “consent” to the imposition of the property tax.

J&K Administration Clarifies New Tax

In the wake of all this criticism, the Jammu and Kashmir administration has issued a clarification stating there has been a degree of confusion because of “factually incorrect and misleading information”.

“The property tax was being levied across the world by municipalities to augment their resources and J&K was the only State/UT in the country which did not impose it,” the administration said.

The administration also said that local municipal bodies are not able to deliver because of poor finances, and that the tax is being levied to strengthen bodies to improve urban development for the betterment of the inhabitants.

“This new property tax policy will help municipal bodies to generate revenue for better municipal services with minimum tax implications to residents,” the statement read.