https://sputniknews.in/20230520/as-brics-enters-economic-ring-g7-faces-new-heavyweight-rival-2026730.html

As BRICS Enters Economic Ring, G7 Faces New Heavyweight Rival

As BRICS Enters Economic Ring, G7 Faces New Heavyweight Rival

Sputnik India

The growing influence of BRICS (Brazil, Russia, India, China, and South Africa) in the global economy is expected to be a key discussion topic at the upcoming... 20.05.2023, Sputnik India

2023-05-20T12:00+0530

2023-05-20T12:00+0530

2023-05-20T12:00+0530

business & economy

brics

g7

dedollarisation

us

japan

hiroshima

india

narendra modi

g-20

https://cdn1.img.sputniknews.in/img/07e7/05/13/2053504_0:160:3072:1888_1920x0_80_0_0_a0df7834958b87a095dec4ba717fff49.jpg

Currently consisting of five member nations, BRICS has drawn interest from 19 other countries, including Algeria, Argentina, Egypt, Iran, Indonesia, Bahrain, Saudi Arabia, and the UAE, who setting their sights on joining the club. With the 15th BRICS Summit in South Africa on the horizon this August, the participating nations are set to explore the possibility of establishing a unified currency, aiming to reduce dependence on the US dollar and reshape the global economic landscape.Could BRICS emerge as a formidable opponent to the collective power of the West? Is the proposed "BRICS currency" poised to challenge the dominance of the dollar? The initiative's primary goal is to decrease reliance on the US dollar in international trade, with the idea of a "common BRICS currency" gaining traction, according to the influential Japanese business newspaper, Sankei Shimbun. Factors such as the recent surge in US interest rates and the Ukraine conflict have led to a strengthening of the dollar, causing the currencies of developing nations to depreciate and sparking discontent. Moreover, there are growing concerns that Washington's sanctions might force some countries out of the dollar sphere.BRICS Has Huge Potential, Which Even US-Led West Can't Deny What has prompted the world's leading economies to show interest in BRICS, and could the proposed "BRICS currency" dethrone "King dollar"? Seeking answers, Sputnik turned to Nikita Maslennikov, who heads the Economics and Finance track at the Institute of Contemporary Development:According to Maslennikov, the G7's concerns primarily stem from the pandemic-induced fragmentation of the global economy, exacerbated by the Ukraine conflict."These twin factors have wreaked havoc on international finance, food supplies, and energy distribution, while additional trade barriers have further deepened regional discord. This poses a palpable and far-reaching risk for all nations, including BRICS. The International Monetary Fund estimates that the fragmentation of the global economy could lead to losses of up to 7% of the world's GDP—equivalent to the combined annual GDP of Germany and Japan. Therefore, the G7 is anxious to gauge the opinions of BRICS nations regarding their stance and proposed measures to combat this formidable challenge."Regarding the prospects of a common currency within BRICS, a topic slated for discussion at the upcoming summit in August, Maslennikov suggests that its realization remains a distant goal."Multiple measures encompassing economic and customs unions, as well as a common market, need to be implemented. Furthermore, all countries must first attain years of political stability as a minimum prerequisite. It took Europe 40 years to introduce its own currency, so the road ahead for BRICS is indeed long," the expert concluded.

https://sputniknews.in/20230505/wishful-thinking-india-rubbishes-western-media-claims-about-suspension-of-talks-on-rupee-trade-1831013.html

https://sputniknews.in/20230518/us-dollar-domination-nearing-the-end-american-investor-tells-sputnik-2022453.html

us

japan

hiroshima

india

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

brics, g7, dedollarisation, us, japan, hiroshima, india, narendra modi, g-20, pivot to asia

brics, g7, dedollarisation, us, japan, hiroshima, india, narendra modi, g-20, pivot to asia

As BRICS Enters Economic Ring, G7 Faces New Heavyweight Rival

The growing influence of BRICS (Brazil, Russia, India, China, and South Africa) in the global economy is expected to be a key discussion topic at the upcoming G7 summit in Hiroshima.

Currently consisting of five member nations, BRICS has drawn interest from 19 other countries, including Algeria, Argentina, Egypt, Iran, Indonesia, Bahrain, Saudi Arabia, and the UAE, who setting their sights on joining the club.

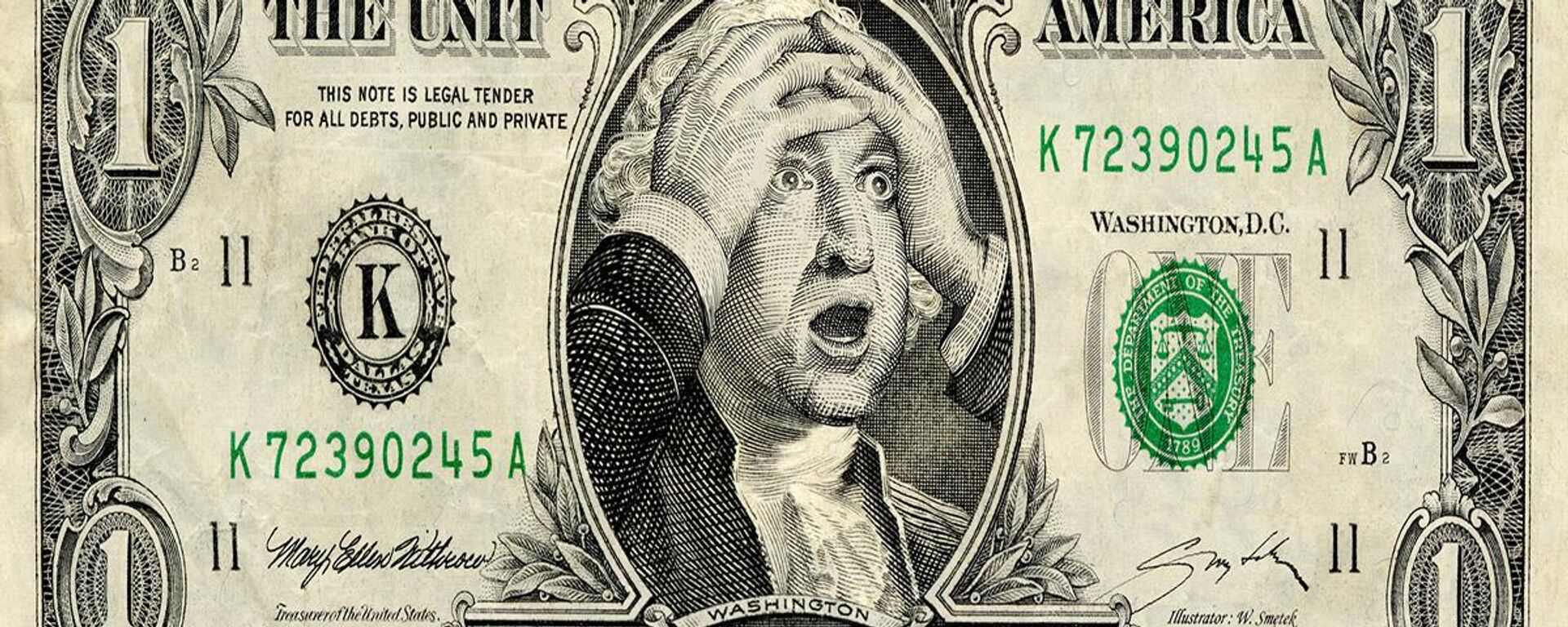

With the 15th BRICS Summit in South Africa on the horizon this August, the participating nations are set to explore the possibility of establishing a unified currency, aiming to reduce dependence on the US dollar and reshape the global economic landscape.

Could BRICS emerge as a formidable opponent to the collective power of the West? Is the proposed "BRICS currency" poised to challenge the dominance of the dollar?

The initiative's primary goal is to decrease reliance on the US dollar in international trade, with the idea of a "common BRICS currency" gaining traction, according to the influential Japanese business newspaper, Sankei Shimbun. Factors such as the recent surge in US interest rates and the Ukraine conflict have led to a strengthening of the dollar, causing the currencies of developing nations to depreciate and sparking discontent. Moreover, there are growing concerns that Washington's sanctions might force some countries out of the dollar sphere.

BRICS Has Huge Potential, Which Even US-Led West Can't Deny

What has prompted the world's leading economies to show interest in BRICS, and could the proposed "BRICS currency" dethrone "King dollar"? Seeking answers, Sputnik turned to Nikita Maslennikov, who heads the Economics and Finance track at the Institute of Contemporary Development:

"The potential of BRICS is undeniable, even for G7 countries. China and India alone are expected to contribute to half of the global GDP growth this year, while their trade volume with the EU and the US exceeds a whopping $1.5 trillion. This recognition underscores the role of BRICS in the global economy and signifies that BRICS is no longer viewed solely as a rising force but as a business partner crucial for future progress. The increasing economic weight of BRICS member states and aspiring participants is translating into political influence."

According to Maslennikov, the G7's concerns primarily stem from the pandemic-induced fragmentation of the global economy, exacerbated by the Ukraine conflict.

"These twin factors have wreaked havoc on international finance, food supplies, and energy distribution, while additional trade barriers have further deepened regional discord. This poses a palpable and far-reaching risk for all nations, including BRICS. The International Monetary Fund estimates that the fragmentation of the global economy could lead to losses of up to 7% of the world's GDP—equivalent to the combined annual GDP of Germany and Japan. Therefore, the G7 is anxious to gauge the opinions of BRICS nations regarding their stance and proposed measures to combat this formidable challenge."

Regarding the prospects of a common currency within BRICS, a topic slated for discussion at the upcoming summit in August, Maslennikov suggests that its realization remains a distant goal.

"At present, the focus lies on determining the conditions for BRICS countries to transition to using national currencies in bilateral settlements. The creation of a unified currency represents a more intricate and protracted stage, requiring the establishment of a regional monetary system, a unified payment mechanism governed by shared management and coordination," Maslennikov says.

"Multiple measures encompassing economic and customs unions, as well as a common market, need to be implemented. Furthermore, all countries must first attain years of political stability as a minimum prerequisite. It took Europe 40 years to introduce its own currency, so the road ahead for BRICS is indeed long," the expert concluded.