https://sputniknews.in/20230522/days-after-clean-chit-adani-groups-market-capitalization-hits-12-trln-2109008.html

Days After Clean Chit, Adani Group's Market Capitalization Hits $1.2 Trln

Days After Clean Chit, Adani Group's Market Capitalization Hits $1.2 Trln

Sputnik India

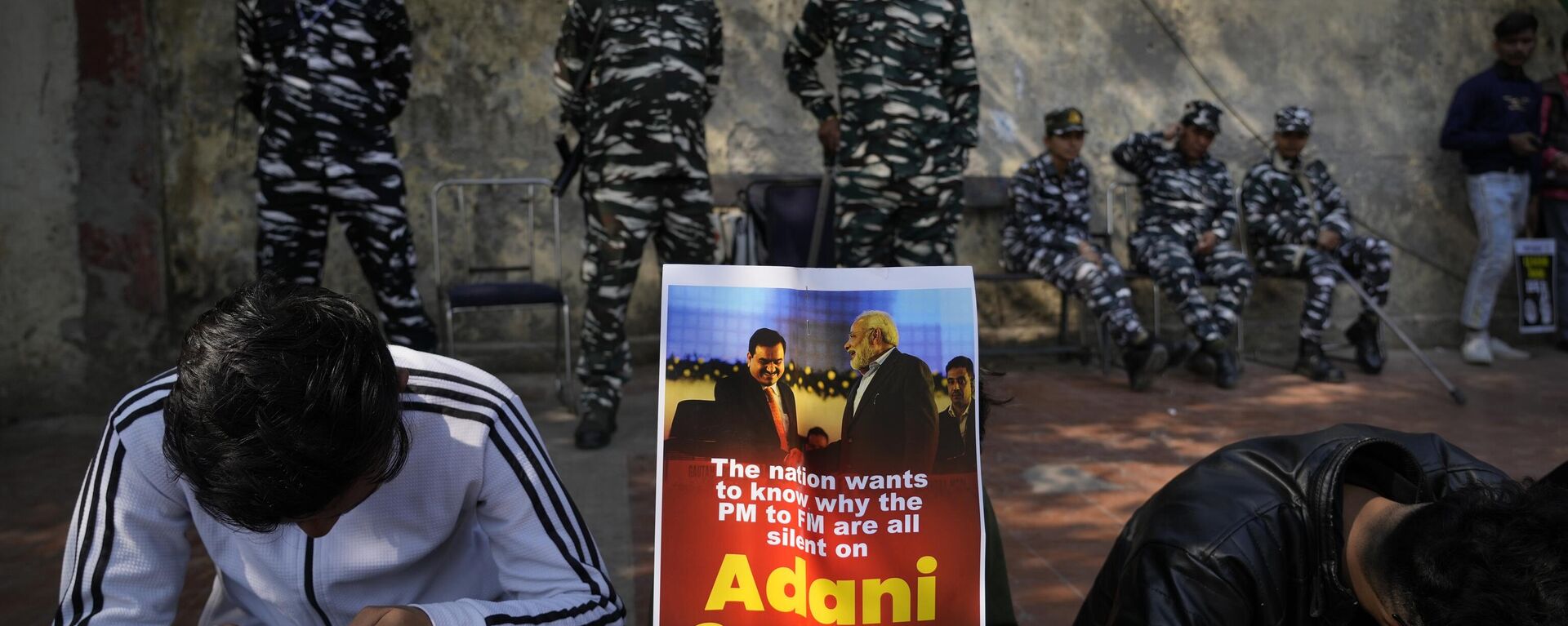

Adani Group's shares went into a free fall in January after US short-seller Hindenburg Research accused the Indian business group of stock manipulation and committing accounting fraud.

2023-05-22T18:10+0530

2023-05-22T18:10+0530

2023-05-22T18:10+0530

business & economy

gautam adani

supreme court of india

tax evasion

offshore tax haven

business

https://cdn1.img.sputniknews.in/img/07e7/02/02/728957_0:161:3071:1888_1920x0_80_0_0_ef1d7187b64df6208e3f58638314ccb8.jpg

Shares of Indian conglomerate, Adani Group's listed companies, witnessed at least a 15 percent jump during intra-day trading in the country's financial capital Mumbai on Monday.While the conglomerate's flagship company Adani Enterprises' stocks surged by as much as 18 percent, Adani Wilmar rose by 10 percent, Adani Ports rallied by 8.15 percent and Ambuja Cements grew by 6 percent. Other group firms, including Adani Transmission, Adani Green Energy, Adani Total Gas, Adani Power, and its media business led by NDTV were up by 5 percent.Also, with the rise in its shares, the group's market capitalization touched the $1.2 trillion mark. On Friday, the total shares of Adani Group were valued at $1.1 trillion.The development came only three days after a panel set up by the Supreme Court gave a clean chit to the Ahmedabad-based business group over US investment group Hindenburg Research's allegations.In its report, the committee of experts stated that prima facie it didn't find any wrongdoing in the working of the ports to airports major. Also, the panel elaborated that neither there was a "regulatory failure" from SEBI, the market regulator, concerning the Gautam Adani-led empire.

https://sputniknews.in/20230519/apex-court-panels-clean-chit-to-adani-group-over-hindenburg-allegations-2053388.html

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

adani group market capitalization, market capitalization adani group, market capitalization of adani group, market capitalization of adani group, market capitalization adani group, adani group shares surge, adani group supreme court panel, adani group supreme court committee,

adani group market capitalization, market capitalization adani group, market capitalization of adani group, market capitalization of adani group, market capitalization adani group, adani group shares surge, adani group supreme court panel, adani group supreme court committee,

Days After Clean Chit, Adani Group's Market Capitalization Hits $1.2 Trln

Adani Group's shares went into a free fall in January after US short-seller Hindenburg Research accused the Indian business group of stock manipulation and committing accounting fraud.

Shares of Indian conglomerate, Adani Group's listed companies, witnessed at least a 15 percent jump during intra-day trading in the country's financial capital Mumbai on Monday.

While the conglomerate's flagship company Adani Enterprises' stocks surged by as much as 18 percent, Adani Wilmar rose by 10 percent, Adani Ports rallied by 8.15 percent and Ambuja Cements grew by 6 percent.

Other group firms, including Adani Transmission, Adani Green Energy, Adani Total Gas, Adani Power, and its media business led by NDTV were up by 5 percent.

Also, with the rise in its shares, the group's market capitalization touched the $1.2 trillion mark. On Friday, the total shares of Adani Group were valued at $1.1 trillion.

The development came only three days after a panel set up by the Supreme Court gave a clean chit to the Ahmedabad-based business group over US investment group Hindenburg Research's allegations.

In its report, the committee of experts stated that prima facie it didn't find any wrongdoing in the working of the ports to airports major.

Also, the panel elaborated that neither there was a "regulatory failure" from SEBI, the market regulator, concerning the Gautam Adani-led empire.

"In one of the patches where the price rose,

the foreign portfolio investors (FPIs) under investigation were net sellers. One investing entity that had purchased across the patches had purchased far more of other securities. In nutshell, there was no coherent pattern of abusive trading that has come to light," the panel said in a report submitted to the apex court.