https://sputniknews.in/20230618/shell-petroleums-plan-to-exit-marks-turning-point-for-pakistans-energy-sector-2544761.html

Shell Petroleum's Plan to Exit Marks Turning Point for Pakistan's Energy Sector

Shell Petroleum's Plan to Exit Marks Turning Point for Pakistan's Energy Sector

Sputnik India

UK-based multinational oil and gas company Shell Petroleum announced that it would be leaving Pakistan after over 75 years of operations.

2023-06-18T19:02+0530

2023-06-18T19:02+0530

2023-06-18T19:02+0530

world news

pakistan

global oil production

oil supplies

https://cdn1.img.sputniknews.in/img/07e7/06/12/2545134_0:320:3072:2048_1920x0_80_0_0_da3c6ad5acbe976ac5def0949f32b756.jpg

Shell cited strategic considerations and a will to focus on core business activities as the reasons behind shutting down operations in Pakistan. The company is currently going through a shift and it has been actively divesting from various markets. In the recent past, it attempted to divest from Nigeria, and exited the home energy retail market in parts of Europe, citing "tough market conditions."Hence, this means the exit from Pakistan is not an isolated issue, but rather Shell's global review of its retail business. Global multinationals do go through periods of global expansion and retrenchment.However, this news has raised concerns across the energy sector of Pakistan as many see the petrochemical giant's exit as a matter of grave difficulty for the country amid the ongoing economic crisis.Multinational companies and foreign investors have been facing difficulties doing business in Pakistan due to some decisions made by the government over the past year. These include restrictions on profit repatriation, the purchase of foreign currency, the issuance of letters of credit and so on, all of which have proven seriously disruptive to economic activity.In its recent financial report, Shell Pakistan said finances and the profitability of the company continued to be affected by the current economic challenges. Over the past several months, the company saw an unprecedented 26% depreciation of the Pakistani rupee against the dollar, resulting in significant exchange losses.Financial Outlook and Economic ProspectsWhile Pakistan has faced multiple crises in recent years, the current economic hardships are especially acute, following the devastating monsoon floods of last year, and political instability following the untimely removal of former prime minister Imran Khan from power.According to a survey conducted by Gallup & Gilani Pakistan, three quarters of the two thousand who responded think the country’s economic situation has gotten worse over the last six months.One thing that Pakistan's economists and analysts repeatedly say is that Pakistan cannot thrive without foreign investment, and it must do all it can to convince foreign companies to invest in the country.Although Shell’s exit is not just about the bleak economic prospects in the country, issues of multinational companies (MNCs) facing serious foreign exchange remittance complications played a role.As companies consider their global footprint due to the tightening economic conditions, a worsening financial outlook for Pakistan increases the chances of these companies exiting and investing elsewhere.In order to make the country appealing to foreign companies, Islamabad needs to conduct some serious reforms first. The energy sectors face a myriad of issues and the lack of reforms exacerbates the disincentives for companies like Shell to continue their investments.Obstacles Impacting the Energy SectorA report by financial analyst Uzair Younus stated that in recent months, many companies have announced a retrenchment or divestment of their operations in Pakistan. This includes Lotte Chemical, which announced in January 2023 that it was selling its entire 75 percent stake in the Pakistan business, and Puma Holdings, which sold its 57 percent stake in Pakistan in January as well.The incompetence of many working in the energy sector also affects the overall performance of the industry. The same report suggested that if one is to "dive deeper into the myriad issues facing the energy sector, it will be seen that at one point the sector was overseen by a director-general who was trained as a veterinary doctor!"Nepotism and corruption has been causing much trouble in Pakistan for decades. Moreover, regarding issues such as the growth of smuggling in the market – illegal oil coming in from Iran is an open secret in the country. Liquidity problems arising from the government’s liquidity crunch are only creating additional issues. Such obstacles not only affect the profitability of energy companies, but also cause considerable reputational and legal risks for them.Despite these complications, Shell’s evolving global strategy also has a big role to play in its exit, as many companies still see Pakistan as a country with a huge investment potential and with a population of over 220 million; it has a giant labor market and demand for foreign goods.Who May Step In?If Shell itself is unable and unwilling to maintain its stakes in Pakistan, other domestic companies with available liquidity might possibly buy its shares. Earlier, Taj Energy expressed an interest in acquiring shares of Hascol or Attock Petroleum if they find a new sponsor.Some years back Caltex, a popular petrol company also exited Pakistan, but just a few months ago it announced its return following a long-term trademark licensing agreement between Chevron Brands International LLC, a subsidiary of Chevron Corporation, and Be Energy Limited (BE).Regarding Shell's exit, perhaps some foreign company decides to expand from a smaller to a larger percentage of the Pakistani market – branch networks, synergy, etc., a plethora of different factors can be worked out.However, for the Pakistani politicians it must serve as a wakeup call because few multinational companies will take a chance to undertake new projects in the country until there is clarity on what will transpire next.Hence, political and economic stability is of utmost importance for the South Asian nation in order to attract foreign investment.

https://sputniknews.in/20230614/pakistan-awaits-lower-petrol--diesel-prices-after-large-discounted-russian-oil-shipment--2472835.html

https://sputniknews.in/20230531/amid-exodus-from-pti-imran-khan-alleges-deserters-set-to-form-kings-party-2250508.html

https://sputniknews.in/20230618/pakistani-foreign-minister-invites-iranian-counterpart-to-islamabad---reports-2542917.html

https://sputniknews.in/20230609/russia-on-saudi-arabias-position-on-oil-they-can-make-decisions-on-own-economy-2408969.html

pakistan

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Aneela Rashid

https://cdn1.img.sputniknews.in/img/07e6/0c/0d/74548_0:0:485:484_100x100_80_0_0_821526e967ae85d041e2d30ee34fa1de.jpg

shell leaves pakistan, shell sells business in pakistan, why did shell leave pakistan, shell in pakistan, pakistan energy, pakistan oil

shell leaves pakistan, shell sells business in pakistan, why did shell leave pakistan, shell in pakistan, pakistan energy, pakistan oil

Shell Petroleum's Plan to Exit Marks Turning Point for Pakistan's Energy Sector

UK-based multinational oil and gas company Shell Petroleum announced that it would be leaving Pakistan after over 75 years of operations. What is behind this decision and will it open new avenues for foreign companies to tap into the country?

Shell cited strategic considerations and a will to focus on core business activities as the reasons behind shutting down operations in Pakistan. The company is currently going through a shift and it has been actively

divesting from various markets. In the recent past, it attempted to divest from Nigeria, and exited the home energy retail market in parts of Europe, citing "tough market conditions."

Hence, this means the exit from Pakistan is not an isolated issue, but rather Shell's global review of its retail business. Global multinationals do go through periods of global expansion and retrenchment.

However, this news has raised concerns across the energy sector of Pakistan as many see the petrochemical giant's exit as a matter of grave difficulty for the country amid the ongoing economic crisis.

Multinational companies and foreign investors have been facing difficulties doing business in Pakistan due to some decisions made by the government over the past year. These include restrictions on profit repatriation, the purchase of foreign currency, the issuance of letters of credit and so on, all of which have proven seriously disruptive to economic activity.

In its recent financial report, Shell Pakistan said finances and the profitability of the company continued to be affected by the current economic challenges. Over the past several months, the company saw an unprecedented 26% depreciation of the Pakistani rupee against the dollar, resulting in significant exchange losses.

Financial Outlook and Economic Prospects

"The Company’s management continues to proactively engage with the Government authorities to minimize its exposure further from the foreign exchange losses incurred and recovery of the legacy receivables," the report read.

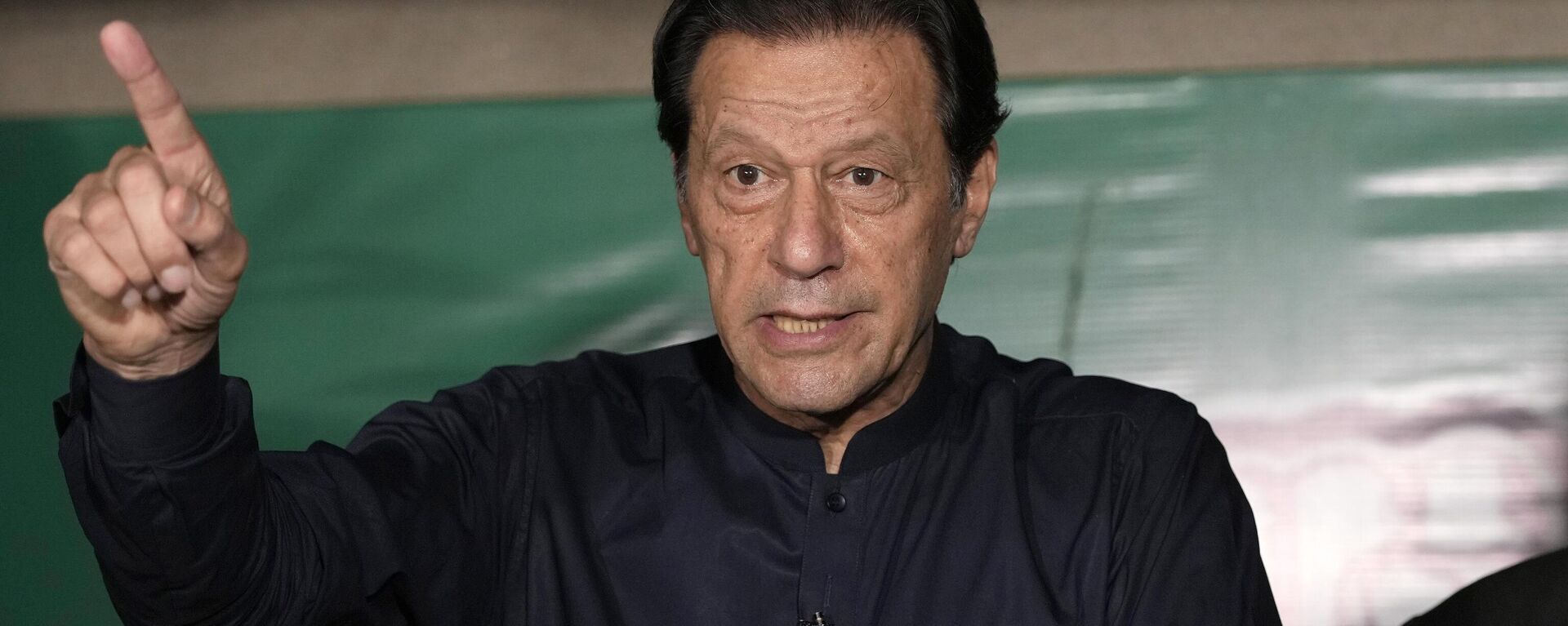

While Pakistan has faced multiple crises in recent years, the current economic hardships are especially acute, following the devastating monsoon floods of last year, and political instability following the untimely removal of former prime minister

Imran Khan from power.

According to a survey conducted by Gallup & Gilani Pakistan, three quarters of the two thousand who responded think the country’s economic situation has gotten worse over the last six months.

One thing that Pakistan's economists and analysts repeatedly say is that Pakistan cannot thrive without foreign investment, and it must do all it can to convince foreign companies to invest in the country.

Although Shell’s exit is not just about the bleak economic prospects in the country, issues of multinational companies (MNCs) facing serious foreign exchange remittance complications played a role.

As companies consider their global footprint due to the tightening economic conditions, a worsening financial outlook for Pakistan increases the chances of these companies exiting and investing elsewhere.

In order to make the country appealing to foreign companies, Islamabad needs to conduct some serious reforms first. The energy sectors face a myriad of issues and the lack of reforms exacerbates the disincentives for companies like Shell to continue their investments.

Obstacles Impacting the Energy Sector

A report by financial analyst Uzair Younus stated that in recent months, many companies have announced a retrenchment or divestment of their operations in Pakistan. This includes Lotte Chemical, which announced in January 2023 that it was selling its entire 75 percent stake in the Pakistan business, and Puma Holdings, which sold its 57 percent stake in Pakistan in January as well.

The incompetence of many working in the energy sector also affects the overall performance of the industry. The same report suggested that if one is to "dive deeper into the myriad issues facing the energy sector, it will be seen that at one point the sector was overseen by a director-general who was trained as a veterinary doctor!"

Nepotism and corruption has been causing much trouble in Pakistan for decades. Moreover, regarding issues such as the growth of smuggling in the market – illegal oil coming in from Iran is an open secret in the country. Liquidity problems arising from the government’s liquidity crunch are only creating additional issues. Such obstacles not only affect the profitability of energy companies, but also cause considerable reputational and legal risks for them.

Despite these complications, Shell’s evolving global strategy also has a big role to play in its exit, as many companies still see Pakistan as a country with a huge investment potential and with a population of over 220 million; it has a giant labor market and demand for foreign goods.

If Shell itself is unable and unwilling to maintain its stakes in Pakistan, other domestic companies with available liquidity might possibly buy its shares. Earlier, Taj Energy expressed an interest in acquiring shares of Hascol or Attock Petroleum if they find a new sponsor.

Some years back Caltex, a popular petrol company also exited Pakistan, but just a few months ago it announced its return following a long-term trademark licensing agreement between Chevron Brands International LLC, a subsidiary of Chevron Corporation, and Be Energy Limited (BE).

Regarding Shell's exit, perhaps some foreign company decides to expand from a smaller to a larger percentage of the Pakistani market – branch networks, synergy, etc., a plethora of different factors can be worked out.

However, for the Pakistani politicians it must serve as a wakeup call because few multinational companies will take a chance to undertake new projects in the country until there is clarity on what will transpire next.

Hence, political and economic stability is of utmost importance for the South Asian nation in order to attract foreign investment.