https://sputniknews.in/20231106/why-should-india-be-worried-about-g7-protocol-banning-russian-diamonds-5261708.html

Why Should India be Worried about G7 'Protocol' Banning Russian Diamonds?

Why Should India be Worried about G7 'Protocol' Banning Russian Diamonds?

Sputnik India

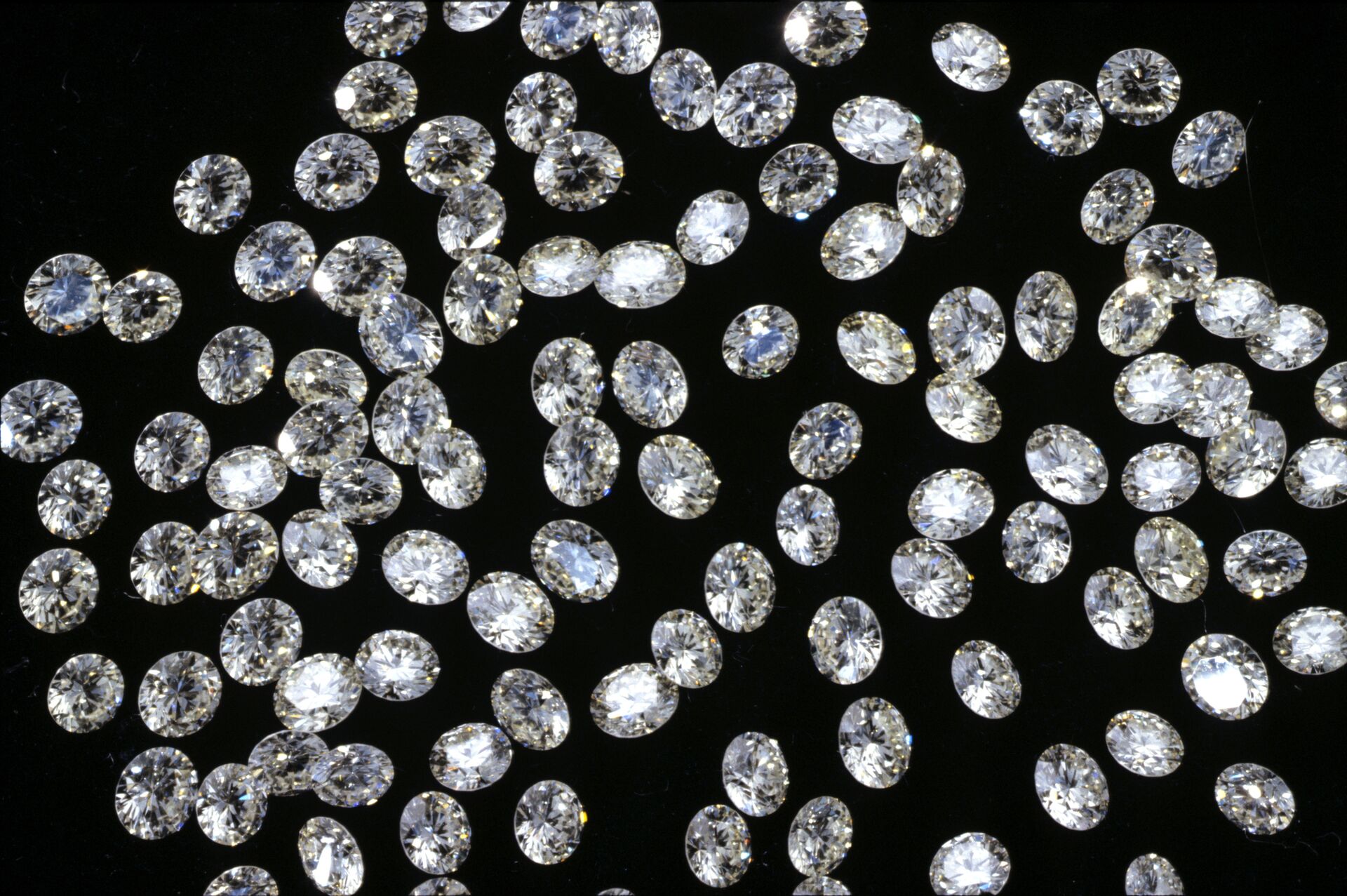

The diamond industry in India, the world’s top importer of rough diamonds and the top exporter of polished stone, has been on the tenterhooks in view of a looming ban by G7 countries on the Russian diamond exports.

2023-11-06T13:01+0530

2023-11-06T13:01+0530

2023-11-06T13:01+0530

india

russia

africa

g7

alrosa

joe biden

diamond mining

diamond industry

raw diamonds

russian diamonds

https://cdn1.img.sputniknews.in/img/07e7/0a/15/4988788_0:164:3057:1884_1920x0_80_0_0_955cc28b6246c73368e4a0a9677027bf.jpg

The diamond industry in India, the world’s top importer of rough diamonds and the top exporter of polished stone, has been on the tenterhooks in view of a looming ban by G7 countries on the Russian diamond exports.Russia not only ranks as the top global producer of diamonds, with most of it mined by state-backed mining firm Alrosa, it has also been a leading source of raw material for the Indian diamond industry. Around 9 of the 10 rough diamonds across the world are polished in Surat before being exported to other countries. Over 50 percent of the polished diamond stone from India was exported to the US in 2021, according to data by United States International Trade Commission.According to diamond industry associations, the G7 countries together constitute around 70 percent of global market for polished diamonds, with the city of Antwerp serving as a de-facto hub for imports in the west.However, since US President Joe Biden signed an Executive Order (EO) in March banning the import of Russian diamonds, Indian industry association Gem and Jewellery Export Promotion Council (GJEPC) have warned of a slowdown in the industry.A G7 delegation which visited India in September was warned that a ban on Russian diamonds would be detrimental to “human rights” of around 2 million workers who have been reeling under recession-like conditions due to Covid-related disruptions and slowdown in western economies.Surat Risks Losing a Significant Market Share, Analyst Warns“That (if Surat’s position as a global diamond trading hub would be affected) is completely in the hands of the Surat industry. If traders exporting to G7 countries and other countries that follow the sanctions like Israel, will follow the protocol, they’ll thrive,” stated Golan, who is also the founder of Edahn Golan Diamond Research and Data is an independent research house.What Would G7 Sanctions Against Russian Diamonds Look Like?According to reports, the G7 countries are considering four options to implement a ban on Russian diamonds, primarily targeting Alrosa.Belgium, which acts a hub of G7 markets, is reportedly calling for a blockchain technology to certify the origin of diamonds. India, on the other hand, has called for self-regulatory approach without the use of technology.Further, there are concerns in the Indian industry that the G7 ‘Protocol’ could take the global diamond supply chains away from Surat and further reinforce Belgium’s status, which might come at expense of India’s.However, Gohan dismisses these concerns in the Indian industry.He reckoned that the G7 decision wasn’t aimed at centralizing supply chains away from India to Belgium.“This is about hurting Russia economically, that is the focus. The G7 doesn't concern itself with who trades where and how. They are seeking to limit Russia’s ability to generate income from diamonds,” stated Gohan.Concerns in AfricaAccording to media reports, Africa’s diamond-producing nations have also expressed their unease with the so-called G7 Diamond Protocol.Around 60 percent of the global diamonds are mined in 19 African countries, which are represented by the African Diamond Producers’ Association (ADPA).Among African states, Botswana is the world’s second-biggest producer of diamonds. According to Gohan’s data, Botswana exported around $4,588 billion worth of rough diamonds in 2022. The south African state has been a significant contributor to Belgium’s status as a diamond industry hub, thanks to a deal signed between Botswana government and De Beers.The ADPA, which comprises 19 African states, have said that re-routing of stones to Antwerp would add to supply side constraints and drive-up costs. The African countries said that they were left out of the negotiation process altogether. Further, they warned that the G7 ‘protocol’ would undermine the existing Kimberley Process.Gohan, however, argued that the G7 sanctions would benefit African producers.However, as noted by Indian industry insiders, re-routing supply chains of diamonds won't be that easy and may not be economically feasible at all.

https://sputniknews.in/20231019/congress-warns-of-protests-in-gujarat-over-diamond-industry-recession-amid-g7-curbs-4941632.html

india

russia

africa

japan

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

g7 sanctions on russian diamonds, russian diamond exports, surat diamond industry, indian diamond industry, western sanctions against russia, alrosa, botswana diamond exports, kimberley process meeting, g7 foreign ministers meeting, india news, india business news

g7 sanctions on russian diamonds, russian diamond exports, surat diamond industry, indian diamond industry, western sanctions against russia, alrosa, botswana diamond exports, kimberley process meeting, g7 foreign ministers meeting, india news, india business news

Why Should India be Worried about G7 'Protocol' Banning Russian Diamonds?

A diamond industry insider has told Sputnik India that the G7 nations are negotiating a “protocol” geared towards phasing out Russian diamonds from global supply chains.

The diamond industry in India, the world’s top importer of rough diamonds and the top exporter of polished stone, has been on the tenterhooks in view of a looming ban by G7 countries on the Russian diamond exports.

Russia not only ranks as the

top global producer of diamonds, with most of it mined by state-backed mining firm

Alrosa, it has also been a leading source of raw material for the Indian diamond industry.

In the west Indian city of Surat, Russian diamond imports have been critical for maintaining its vault position as a global trading hub for the precious stone.

Around 9 of the 10 rough diamonds across the world are polished in Surat before being exported to other countries. Over 50 percent of the polished diamond stone from India was exported to the

US in 2021, according to data by United States International Trade Commission.

According to diamond industry associations, the G7 countries together constitute around 70 percent of

global market for polished diamonds, with the city of Antwerp serving as a de-facto hub for imports in the west.

However, since

US President Joe Biden signed an Executive Order (EO) in March banning the import of Russian diamonds, Indian industry association Gem and Jewellery Export Promotion Council (GJEPC) have warned of a slowdown in the industry.

A G7 delegation which visited India in September was warned that a ban on Russian diamonds would be

detrimental to “human rights” of around 2 million workers who have been reeling under recession-like conditions due to Covid-related disruptions and slowdown in western economies.

A diamond trader in Gujarat told Sputnik India that it won’t be easy to fill the supply-side gap left by phasing out of Russian rough diamond from Surat’s industry.

Surat Risks Losing a Significant Market Share, Analyst Warns

Edahn Golan, a global diamond industry analyst, told Sputnik India, that the city of Surat would lose a “significant part of the consumer market” if it didn’t comply with the yet-to-be-unveiled G7 sanctions on Russian diamonds.

“That (if Surat’s position as a global diamond trading hub would be affected) is completely in the hands of the

Surat industry. If traders exporting to G7 countries and other countries that follow the sanctions like

Israel, will follow the protocol, they’ll thrive,” stated Golan, who is also the founder of Edahn Golan Diamond Research and Data is an independent research house.

What Would G7 Sanctions Against Russian Diamonds Look Like?

According to reports, the G7 countries are considering four options to implement a ban on Russian diamonds, primarily targeting Alrosa.

Belgium, which acts a hub of G7 markets, is reportedly calling for a blockchain technology to certify the origin of diamonds. India, on the other hand, has called for self-regulatory approach without the use of technology.

“The first thing I think people should understand is the G7 decision will probably be a protocol, not a specific technology use requirement. So, while we don’t know what the exact decision will be, the diamond industry will need to rapidly adapt procedures that adhere to that protocol, be it blockchain, a paper trail, or anything else,” Gohan explained.

Further, there are concerns in the Indian industry that the G7 ‘Protocol’ could take the global diamond supply chains away from Surat and further reinforce Belgium’s status, which might come at expense of India’s.

However, Gohan dismisses these concerns in the Indian industry.

“There is a proposal by the Belgium government that, if accepted, may temporarily require routing exports to G7 through Antwerp. But until G7 announces its decision, we won’t know what the sanctions will look like from an operational standpoint,” the diamond industry researcher said.

He reckoned that the G7 decision wasn’t aimed at centralizing supply chains away from India to Belgium.

“This is about hurting Russia economically, that is the focus. The G7 doesn't concern itself with who trades where and how. They are

seeking to limit Russia’s ability to generate income from diamonds,” stated Gohan.

According to media reports, Africa’s diamond-producing nations have also expressed their unease with the so-called G7 Diamond Protocol.

Around 60 percent of the global diamonds are mined in 19 African countries, which are represented by the African Diamond Producers’ Association (ADPA).

Among African states, Botswana is the world’s second-biggest

producer of diamonds. According to Gohan’s data, Botswana exported around $4,588 billion worth of rough diamonds in 2022. The south African state has been a significant contributor to Belgium’s status as a diamond industry hub, thanks to a deal signed between Botswana government and De Beers.

This month, the ADPA wrote to the Kimberley Process, a global mechanism regulating trade in diamonds, opposing the upcoming G7 Diamond Protocol.

The ADPA, which comprises 19 African states, have said that re-routing of stones to Antwerp would add to supply side constraints and drive-up costs. The African countries said that they were left out of the negotiation process altogether. Further, they warned that the G7 ‘protocol’ would undermine the existing Kimberley Process.

Gohan, however, argued that the G7 sanctions would benefit African producers.

“Any company mining in Africa will have less competition in the G7 consumer markets. In addition, the sanctions may lead to a rise in rough diamond prices, which means that African countries will be able to command greater income though royalty payments,” he reckoned.

However, as noted by Indian industry insiders, re-routing supply chains of diamonds won't be that easy and may not be economically feasible at all.

The G7 Diamond Protocol is expected to figure in two key meetings scheduled to kick off on Monday—a Kimberley Process meeting in Zimbabwe and the G7 Foreign Ministers’ meeting in Japan.