Behind India's Push to Strike Liquid Gold Like Guyana

© Sputnik

Subscribe

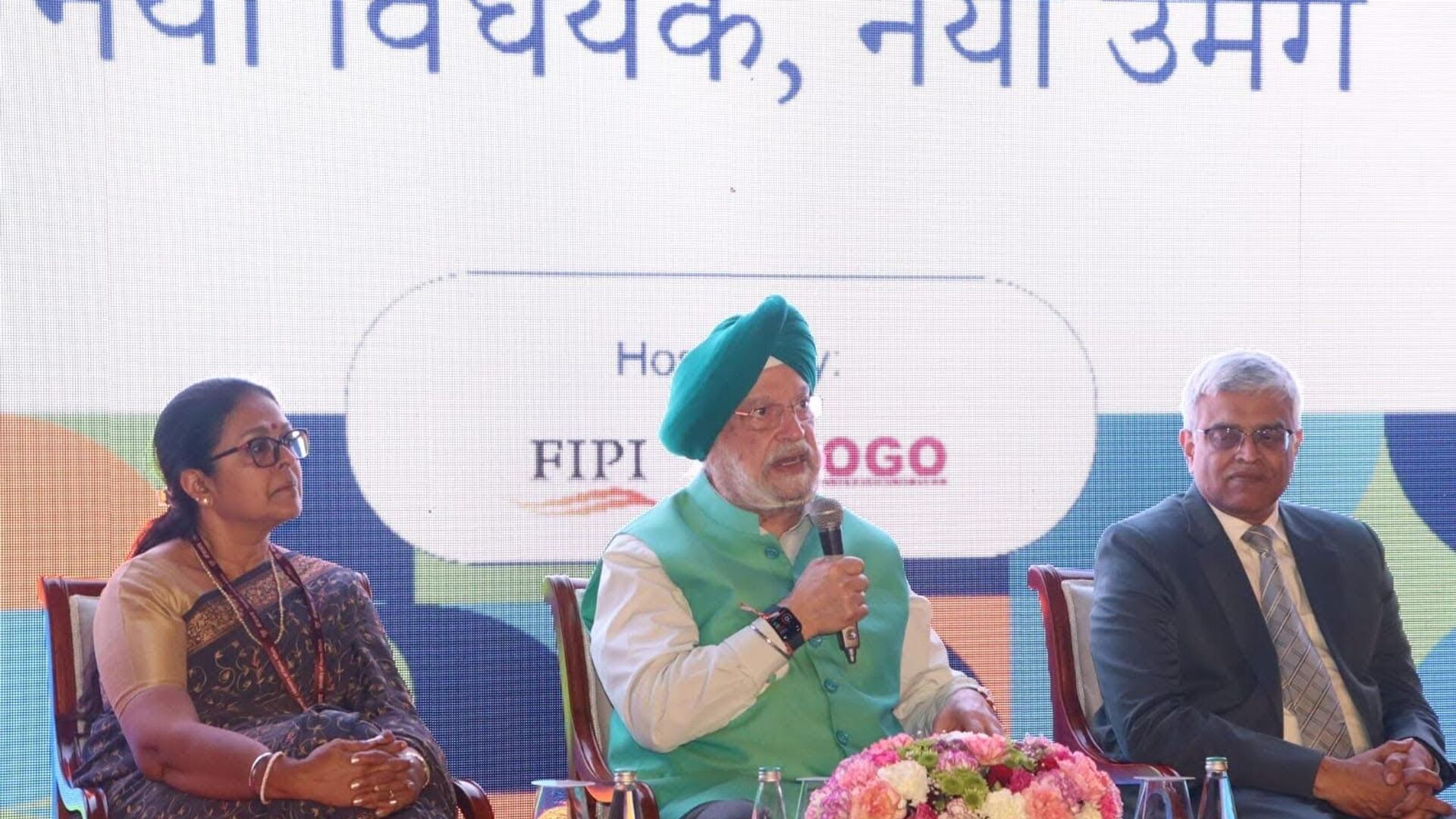

Petroleum Minister Hardeep Singh Puri said India aims to unlock 42 billion tonnes of crude and gas deposits to boost energy self-reliance, praising the Oilfields Regulation & Development Amendment Bill, 2024.

The Oilfields Regulation and Development Amendment Act, 2024, will "energise" the domestic exploration and production (E&P) of untapped energy resources in the country, Puri told an industry interaction on Wednesday evening.

"This significant amendment was made after extensive consultation with both global and local E&P companies," stated Puri. The legislation was passed in India's Lok Sabha (lower house) on 12 March, while clearing the Rajya Sabha (upper house) last December.

"Who knows we might strike gold (crude) like Guyana," Puri stated, referring to the recent discovery of billions of barrels of offshore energy deposits in the South American nation.

He said that several global oil majors have already expressed interest in exploration of the Bay of Bengal region around Andaman and Nicobar Islands for offshore deposits, based on their own seismic surveys.

According to the Directorate General of Hydrocarbons (DGH), 2D and 3D seismic data is currently available for 3.93 million and 1.23 million square kilometres of area located at various onshore and offshore locations. Over 300 Indian and major foreign companies have access to this data.

"New discoveries and explorations are essential if we are to reduce our energy imports and work towards achieving energy independence by the year 2047," stressed Puri.

Explaining the significance of the amended legislation, Puri noted that India was on the way to becoming a $30 trillion economy by 2047, the year which Prime Minister Narendra Modi has said that India would become a developed nation (Viksit Bharat).

"To reach this goal, we must swiftly boost energy production, ensure self-reliance, and provide affordable energy for everyone. This is especially vital for a country like India that is 88% import dependent for crude and 50% import dependent for natural gas given that in the next two decades 25% of global incremental energy demand growth is set to come from India," the minister stated.

According to the minister, the biggest takeaways from the law was that it aims to eliminate the "practice of putting mining and petroleum operations in the same bucket" and introduced a "single-permit system" for all types of mineral oil operations, be it exploration, development or production of conventional oil and gas or unconventional hydrocarbons like shale oil, shale gas, tight oil or tight gas.

Puri said that it seeks to create a new "new framework" for resource-sharing and infrastructure sharing between different operators to bolster viability of oil blocks.

Another draw of the act is that it clarifies the meaning of "mineral oils", which would boost exploration and production of new fuel options like Shale Gas, Shale Oil, Coal Bed Methane, Natural Gas and gas hydrates among others, he highlighted.

Moreover, the new bill seeks to allow 100% foreign participation in Discovered Oil Fields (DSF), which is also in line with India's Hydrocarbon Exploration and Licensing Policy (HELP). Greater foreign involvement is expected to bring in greater financial resources and technological expertise in the E&P sector.

Further, the minister highlighted that the new law was aimed at attracting foreign investments in the sector as it resolved "one of the biggest grievances" of global oil companies interested in India by providing stability in operations, in terms of tenure of the lease and conditions.

In order to facilitate foreign direct investments (FDI) in India, the act also focuses on improving compliance and "decriminalising" the adjudicating mechanism, he said.

He stated that the act would also improve ease of doing business by protecting foreign investors from imposition of additional taxes and duties during the period of lease, which if imposed would be adjusted from the royalty fee.

Around 76% of the total area under exploration had only come under "active exploration" since 2014, which was part of broader policy reforms undertaken by the government, Puri underscored.

He highlighted that the policy decisions to move towards "revenue sharing contracts (RSC)", establishing a data centre in Houston for ease of data viewing by foreign investors and incentivising the discovery of potential basins had also helped in increasing the active exploration area in India.

The minister stated that India had also started to promote an "early monetisation" of coal bed methane as well as introduced natural gas pricing and marketing reforms.

He said that around one million square kilometres (SKM) of "no-go areas" in the surrounding oceans had been opened up by the current government, which had hitherto remained "blocked".

"We have successfully awarded 144 blocks through a competitive bidding process, encompassing over 250,000 sq km, and secured a committed investment of US $3.37 billion under the Open Acreage Licensing Programme (OALP) from Round One to Round Eight. OALP Round IX (January 2024) had witnessed 60 bids for 28 blocks that were put on offer and 38% fell in the earlier ‘No-Go’ area," he told the gathering.

The OALP bidding for 10th round, India's biggest till date, was opened last month. According to ministry estimates, over 192,000 square kilometres of area, including 91% in offshore blocks, is up for grabs for exploration and production purposes.

While 25 blocks on offer are located across 13 sedimentary basins spread across the country, nineteen offshore blocks are located in deepwater (DW) and ultra-deepwater (DW) areas.

Around 11 of the bidding blocks are located in Category II areas, with five of them in Category III areas.

Sedimentary basins with reserves being produced and exploited are classified under Category I, while basins having "contingent resources" to be developed and monetised fall under Category II. Finally, Category III basins are those with "prospective resources" waiting to be explored and discovered, according to DGH criteria.