https://sputniknews.in/20230811/indias-russian-crude-imports-backed-by-substantial-government-support-expert-3550585.html

India's Russian Crude Imports Backed By Substantial Government Support: Expert

India's Russian Crude Imports Backed By Substantial Government Support: Expert

Sputnik India

India's imports of Russian oil which have witnessed a record surge in recent months, are backed by substantial support from the federal government, an energy expert has said.

2023-08-11T18:39+0530

2023-08-11T18:39+0530

2023-08-11T18:39+0530

business & economy

india

russia

moscow

global oil production

oil exporters

oil supplies

russian oil

delhi

new delhi

https://cdn1.img.sputniknews.in/img/07e7/01/05/396652_0:343:5456:3412_1920x0_80_0_0_e6319123b46c8408e4e7bc91f2c9e080.jpg

India's imports of Russian oil which have witnessed a record surge in recent months, are backed by substantial support from the federal government, an energy expert has told Sputnik India.The comments of Arpit Chandna, a specialist in oil trade who is linked to Refinitiv, an international organization tracking global crude supplies and deliveries, come at a time when reports in the Western media claimed that discounts on Russia's Ural blends delivered to India have come down.The report further stated that despite the escalation in the purchasing cost of Russian crude, the pricing was still lower than other oil-producing nations in the Gulf.In July, the supply share of Saudi Arabia & Iraq to India was around 20 percent and 11 percent, respectively, compared to 18 percent and 16 percent in June.Remarkably, Russian supplies assume a pivotal role, constituting around 44% of India's aggregate crude imports.Russia Dominates in India's Crude Import BasketThis compelling dominance, he emphasized, has been consistently maintained at over 40% since April 2023, surpassing the contributions of Saudi Arabia, Iraq, and other suppliers such as the UAE and the US.This trend, Arpit asserted, highlights the recalibration of traditional supplier dynamics, driven chiefly by varying pricing strategies."In navigating this landscape, Indian refiners have garnered substantial government support in sustaining Russian exports," he added, underlining the unwavering support that Moscow's crude industry has received from its long-time friend and strategic partner New Delhi since its military conflict with Kiev which started in February last year.He pointed out that the current market landscape is underpinned by the strategic implementation of deeper production cuts by OPEC and Russia.Crude Demand to Witness a Uptick in IndiaDespite Russia's production cuts, he expects demand for crude to pick up in the world's largest democratic nation.Oil supplies from Russia to India witnessed a slight drop in July after registering record volumes the previous month.While India received 2.11 million barrels per day (bpd) in June, the numbers declined to 2.09 million bpd in July. But Arpit attributed the fall to the arrival of Monsoon when demand typically shows a decline almost every year.In this context, he mentioned that India's overall crude oil demand is expected to be marginally lower during the August and September months as conceived from last year's import volumes as well as seen in seasonality demand patterns.

https://sputniknews.in/20230718/russia-india-economic-relationship-will-continue-to-grow-expert-says-3054972.html

india

russia

moscow

delhi

new delhi

gulf countries

middle east

ukraine

south asia

eurasia

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Pawan Atri

https://cdn1.img.sputniknews.in/img/07e6/0c/13/139630_147:0:831:684_100x100_80_0_0_8fa2b25903e7787fe6a2698552c167df.png

russian crude imports india, russian crude imports india, russian oil imports india, russian oil supplies india, russian crude supplies india, russian oil deliveries india, russian crude deliveries india, moscow oil exports delhi, moscow oil exports new delhi,

russian crude imports india, russian crude imports india, russian oil imports india, russian oil supplies india, russian crude supplies india, russian oil deliveries india, russian crude deliveries india, moscow oil exports delhi, moscow oil exports new delhi,

India's Russian Crude Imports Backed By Substantial Government Support: Expert

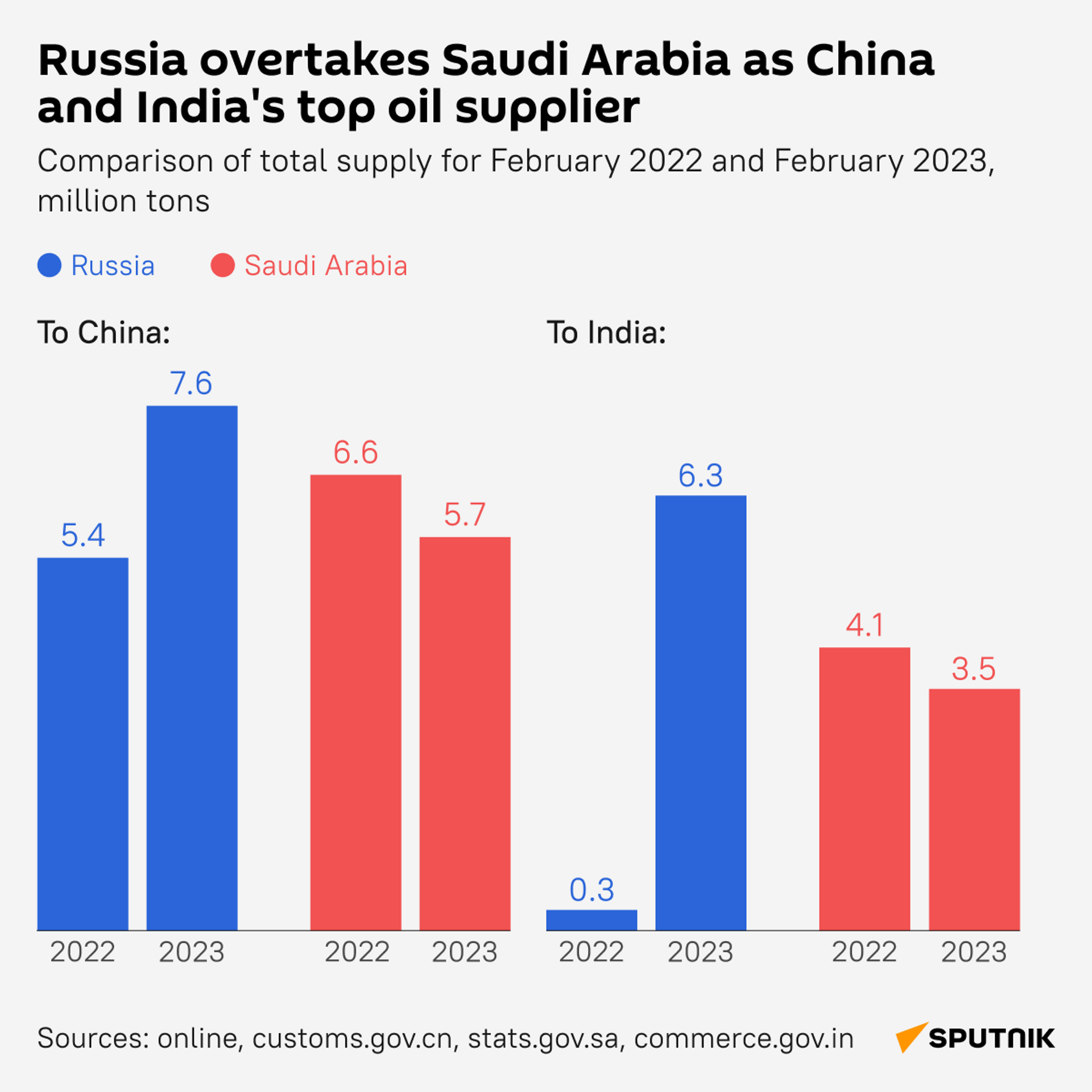

New Delhi has emerged as Moscow's second largest crude importer after Beijing in the wake of the Western-imposed economic sanctions on Russia following its special military operation in Ukraine.

India's imports of Russian oil which have witnessed a record surge in recent months, are backed by substantial support from the federal government, an energy expert has told Sputnik India.

The comments of Arpit Chandna, a specialist in oil trade who is linked to Refinitiv, an international organization tracking global crude supplies and deliveries, come at a time when reports in the Western media claimed that discounts on Russia's Ural blends delivered to India have come down.

The report further stated that despite the escalation in the purchasing cost of Russian crude, the pricing was still lower than other oil-producing nations in the Gulf.

India, positioned as the third-largest global crude importer, relies significantly on imported crude, accounting for 80% of its refinery demands.

In July, the supply share of Saudi Arabia & Iraq to India was around 20 percent and 11 percent, respectively, compared to 18 percent and 16 percent in June.

Remarkably, Russian supplies

assume a pivotal role, constituting around 44% of India's aggregate crude imports.

Russia Dominates in India's Crude Import Basket

This compelling dominance, he emphasized, has been consistently maintained at over 40% since April 2023, surpassing the contributions of Saudi Arabia, Iraq, and other suppliers such as the UAE and the US.

This trend, Arpit asserted, highlights the recalibration of traditional supplier dynamics, driven chiefly by varying pricing strategies.

"These traditional players have encountered a significant reduction in their market share, largely attributed to the higher premiums they levy, a contrast to the more favorable terms provided by Russian counterparts," the trade pundit told Sputnik India on Friday.

"In navigating this landscape, Indian refiners have garnered substantial government support in sustaining Russian exports," he added, underlining the unwavering support that Moscow's crude industry has received from its long-time friend and strategic partner New Delhi since its military conflict with Kiev which started in February last year.

He pointed out that the current market landscape is underpinned by the strategic implementation of deeper production cuts by OPEC and Russia.

"Russia is voluntarily cutting oil exports by 500,000 bpd in August, in addition to another 500,000 bpd it agreed to cut earlier this year, in line with the output cuts announced by the Saudi Arabia-led OPEC," Arpit observed.

Crude Demand to Witness a Uptick in India

Despite Russia's production cuts, he expects demand for crude to pick up in the world's largest democratic nation.

Oil supplies from Russia to India

witnessed a slight drop in July after registering record volumes the previous month.

While India received 2.11 million barrels per day (bpd) in June, the numbers declined to 2.09 million bpd in July. But Arpit attributed the fall to the arrival of Monsoon when demand typically shows a decline almost every year.

In this context, he mentioned that India's overall crude oil demand is expected to be marginally lower during the August and September months as conceived from last year's import volumes as well as seen in seasonality demand patterns.

"The following is likely to

recover post-monsoon and at the start of the festive season in India supported by domestic demand for refined products," he concluded.