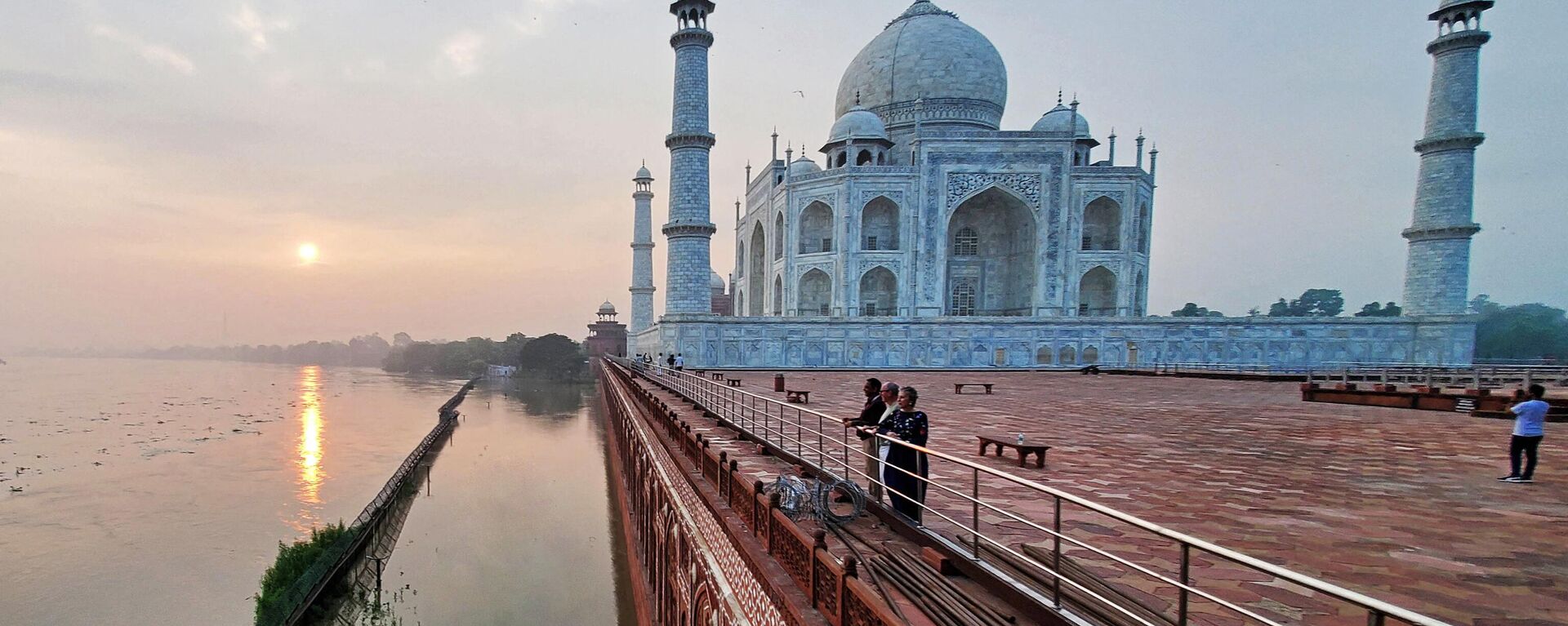

New Silicon Valley? How Startups Could Make India World's Third-Largest Economy by 2030

© AFP 2023 MANJUNATH KIRAN

Subscribe

India has arguably the best ecosystem for startups, given its investment prospects and the nation's creativity. Sputnik India explores whether Bharat will soon become the New Silicon Valley.

India, the world's 5th largest economy, has experienced a remarkable technological breakthrough in recent years.

With a GDP growth rate of 7% per year and a projected entry into the top 3 global economies by 2030, India offers almost the perfect conditions for the rapid development of startups and technological progress.

What are the major pillars of India's economic growth? What are the reason behind this country's success as a hub for startups, and what are the most promising Indian startups to watch out for?

Sputnik India tried to find the answer.

Key Secrets Behind India's Phenomenal Growth

There are several essential factors contributing to India's rise as a prominent player in the startup ecosystem:

1.

Young Population and Tech-Savvy Culture. India boasts a young population of 1.4 billion people, with an average age of 27. Younger individuals are more inclined to embrace technology, driving the adoption and development of innovative solutions. This demographic advantage positions India as a hotbed for tech startups.2.

Urbanization and Economic Growth. India's urban population is projected to climb nearly 28% by 2035, providing an additional stimulus for economic development. As more people migrate to cities, the demand for tech-driven solutions and services will continue to grow.3.

Abundance of Skilled Professionals. India is home to a pool of highly-skilled engineers and tech professionals who have made significant contributions to the global tech industry. Prominent CEOs of major US companies like Google, Microsoft, Adobe, and IBM are of Indian origin, highlighting the nation's talent in the technology sector.4.

Rapid Growth of E-commerce: India ranked second globally in terms of the speed of e-commerce growth in 2022. Online shopping and delivery services have gained immense popularity, driving the expansion of the e-commerce sector. This trend is expected to continue in the coming years, presenting lucrative opportunities for startups in this space.5.

Accessible Infrastructure. India provides a favorable environment for the growth of online businesses. The country offers affordable smartphones with internet connectivity, a robust digital payment system (UPI), and a unique biometric digital ID system (Aadhaar) that covers a significant portion of the population. These factors create a conducive ecosystem for online entrepreneurship.6.

Business-Friendly Environment. India ranks 63rd out of 180 countries in terms of ease of doing business. The country's high level of democracy, political stability, and adherence to the rule of law make it an attractive destination for investment. These favorable conditions have led to a steady inflow of investments into the country.

Indian Prime Minister Narendra Modi speaks at 17th century Mughal-era Red Fort monument on country's Independence Day in New Delhi, India, Tuesday, Aug.15, 2023.

© AP Photo / Manish Swarup

Investor Perspectives on Indian Startups

While India has been traditionally associated with IT service companies and outsourcing, the landscape has drastically changed in recent years. International tech startups emerging from India are garnering attention due to their innovative business models and growth potential, often on par with their global counterparts, including American startups.

In 2021, India attracted $70 billion in venture investments, and although the volume decreased to $56.5 billion in 2022, the number of deals remained consistent, with around 1,500 transactions, marking a 200% increase compared to the period before 2021. These figures are a testament to India's growing prominence in the global startup ecosystem.

India's share of the global venture capital market is expected to continue rising. It increased from 3% in 2020 to 5% by 2022, despite political events, supply chain disruptions, inflation, and global central bank policies. According to Axevil Capital, a significant portion of the investments currently flowing into China will soon be directed towards India.

Investments in India have become the largest in the Indo-Pacific region, reaching a record-breaking 20%. Additionally, the number of Indian startups with a valuation of over $1 billion has surpassed China for the second consecutive year, with 23 compared to China's 11.

India's startup ecosystem is far from being considered immature. The South Asian giant has attracted substantial investments and boasts professional teams. Dedicated funds solely focused on Indian startups, such as India Fund VIII by Sequoia Capital with a capital of $2 billion and Lightspeed India/Southeast Asia-dedicated fund with $500 million, further demonstrate confidence in the Indian market.

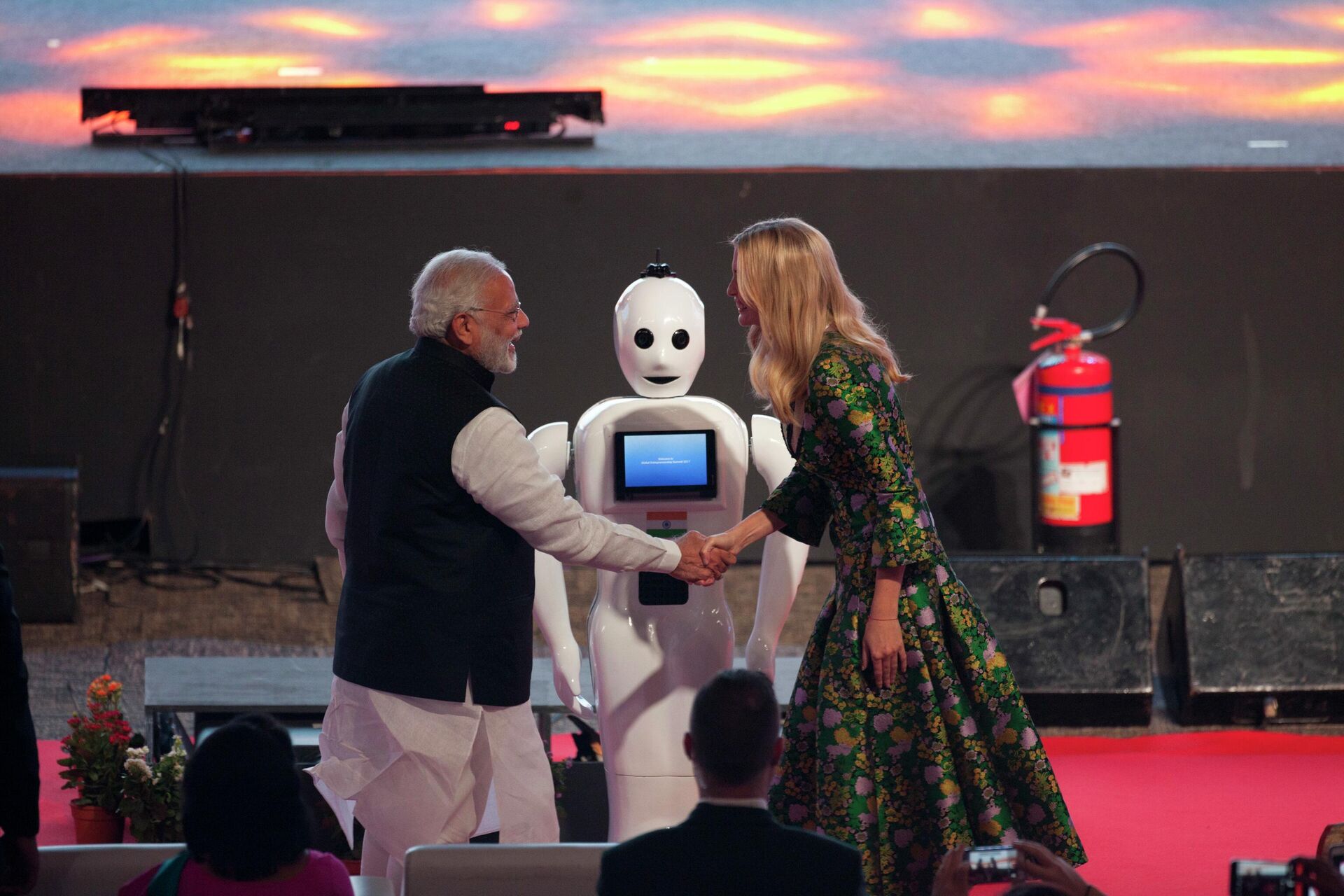

Indian Prime Minister Narendra Modi, left and U.S. presidential adviser and daughter Ivanka Trump greet each other after they press the button on a robot during the opening of the Global Entrepreneurship Summit in Hyderabad, India, Tuesday, Nov. 28, 2017.

© AP Photo / Mahesh Kumar A.

What Are Promising Indian Sectors for Investment?

Analyzing the investment landscape in India for 2022 reveals that venture funds are predominantly favoring three sectors:

1.

Consumer Tech. Consumer tech encompasses various domains, including e-commerce, educational technology, healthcare, and gaming. Online shopping has experienced significant growth in India, making it an attractive sector for investment.2.

Fintech. India's fintech sector offers convenience and security through personal data protection using biometrics and encryption. Online banking and other financial technology solutions have gained traction, presenting numerous investment opportunities.3.

Software as a Service (SaaS). SaaS solutions, particularly cloud-based technologies, cater to businesses of all sizes. These scalable solutions help companies cut operational costs and streamline processes. As a result, the SaaS sector in India has immense potential for growth and investment.In 2022, three highly successful IPOs were launched in these sectors:

Karza Technologies ($80 million) offers financial data verification solutions, serving over 400 B2B companies.

FirstCry ($240 million) operates an online marketplace for children's products, serving more than 13 million users and over 6,000 brands.

Unbxd ($54 million) provides AI-powered software for e-commerce platforms, utilized by over 200 million companies worldwide.

A MahaDeviBot, a robot orchestra instrument, is seen ready for an upcoming KarmetiK Machine Orchestra concert at the California Institute for the Arts campus, Wednesday, May 11, 2011, in Valencia, Calif.

© AP Photo / Damian Dovarganes

What Are Emerging Indian Startups to Watch Out for?

While 88% of investments in Indian companies are made at later stages, providing a level of security due to the proven business models, it is essential to identify promising early-stage startups. India has already surpassed the United Kingdom in terms of investment inflows and China in terms of the number of startups with valuations exceeding $1 billion per year. Several Indian startups are expected to make significant breakthroughs in the coming years.

Here are three startups to keep an eye on:

BYJU's

BYJU's is a multi-profile EdTech platform offering personalized learning programs for school students. Key highlights of this startup include:

Over 115 million users, making it the world's largest platform of its kind.

Continuously expanding course offerings.

A hybrid business model combining online and offline learning.

A focus on profitability in the current year, streamlining operations of unprofitable units.

Financial stability and access to a $2 billion credit line for potential acquisitions.

Razorpay

Razorpay is a leading fintech platform trusted by over 8 million Indian businesses operating online. Key features of this startup include:

Wide adoption, with 79% of Indian startups that raised over $1 billion per year becoming Razorpay customers.

A diversified business model, including higher-margin products like Capital and Rize, contributing to approximately 20% of total revenue.

Financial stability, with $500 million in investments and modest expenditure.

An omnichannel ecosystem, attracting customers from traditional sectors.

Geographical expansion plans into neighboring countries with a population of approximately 600 million people.

Gupshup

Gupshup is a leading platform connecting businesses with customers through IP messaging. Noteworthy aspects of this startup include:

Capturing 75% of the IP messaging market share in India, serving over 55,000 businesses.

Aiming to become a communication super app.

Strong market presence in traditional sectors.

Potential for global expansion.

The rise of Indian startups has transformed the investment market, with India emerging as a global hub for innovation and entrepreneurship. The country's favorable demographics, urbanization, skilled workforce, booming e-commerce sector, accessible infrastructure, and business-friendly environment have all contributed to its success.

As India continues to attract substantial investments, sectors such as consumer tech, fintech, and SaaS present promising opportunities for growth. Investors and entrepreneurs alike should keep a close eye on emerging Indian startups, including BYJU's, Razorpay, and Gupshup, as they pave the way for India's bright future in the startup ecosystem.