https://sputniknews.in/20231206/take-that-dollar-india--kenya-to-finance-development-projects-in-inr-5721660.html

In Blow to USD, India & Kenya Back Development Project Financing in INR

In Blow to USD, India & Kenya Back Development Project Financing in INR

Sputnik India

India has taken policy measures to move away from the USD and switch to INR in trade settlements following the disruptions caused by Western sanctions against Moscow last year.

2023-12-06T11:56+0530

2023-12-06T11:56+0530

2023-12-06T11:58+0530

narendra modi

india

kenya

new delhi

reserve bank of india (rbi)

ministry of external affairs (mea)

dedollarisation

africa

western sanctions

sanctions

https://cdn1.img.sputniknews.in/img/07e7/0c/06/5723954_0:160:3072:1888_1920x0_80_0_0_fe789b79e5d705f56b289b4908b61960.jpg

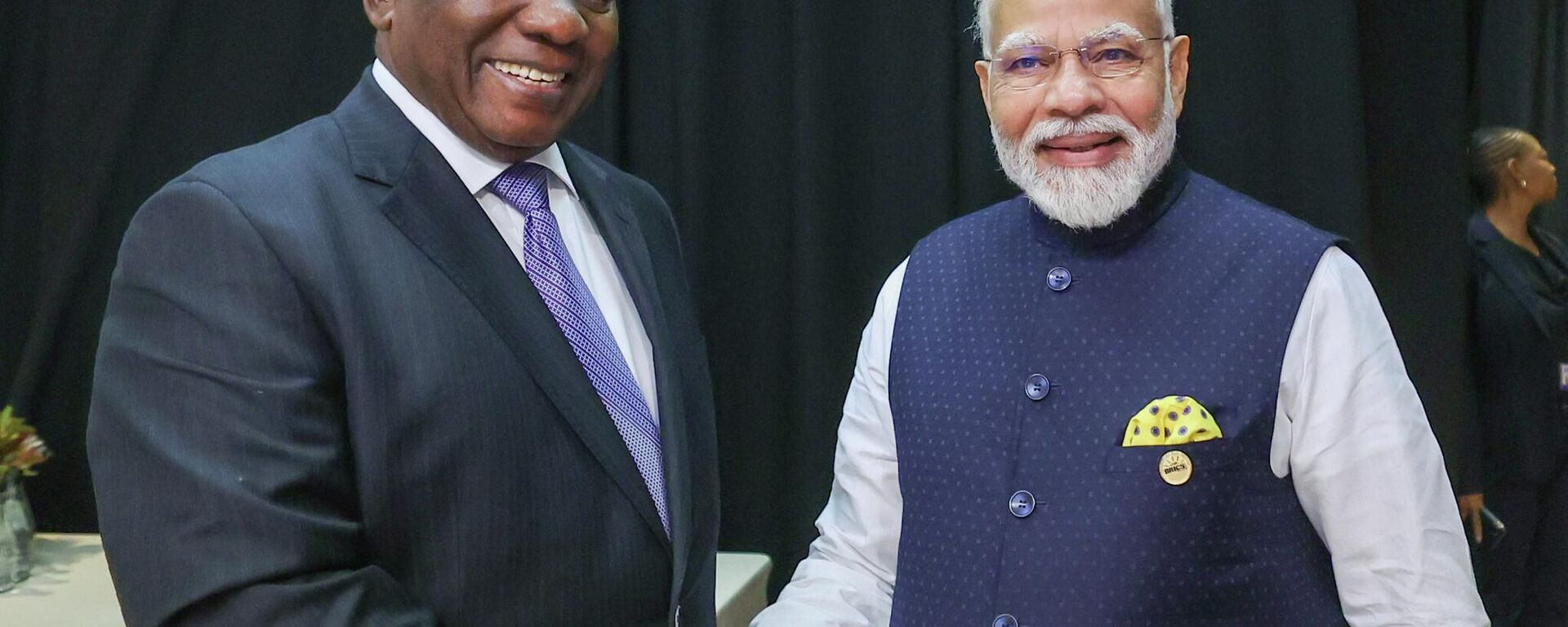

Indian Prime Minister Narendra Modi and Kenyan President William Ruto have directed the relevant agencies in their countries to work towards implementing development project financing between the two nations using the Indian rupee (INR).A joint statement released after the summit-level talks between the two leaders in New Delhi on Tuesday stated that the decision was taken to boost the development partnership among the nations.The Indian credit lines will be deployed for the mechanization of agriculture projects in Kenya, in line with the national development priorities of the African state.Addressing a special press briefing in New Delhi, India’s Secretary (Economic Relations) at the Ministry of External Affairs (MEA), Dammu Ravi, highlighted that Kenya was one of India’s strongest developmental partners in Africa.Ravi said that both the leaders discussed extending cooperation in digital public infrastructure (DPI), including the use of India’s domestic digital payments system Unified Payments Interface (UPI).He also highlighted that that Modi and Rutto discussed ways to expand cooperation in trade and investment.India’s Push to Switch from US Dollar to INRIn recent months, New Delhi and Nairobi have taken measures to promote the use of national currencies in trade settlements, according to Indian government.In March this year, India’s new Foreign Trade Policy (FTP) for 2023-28 time period called for encouraging trade in INR to shield Indian businesses from disruptions such as unilateral sanctions or economic crisis.

https://sputniknews.in/20230828/africas-infrastructure-development-ranks-high-in-indias-priorities-ex-envoy-3880155.html

india

kenya

new delhi

africa

global south

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

dedollarisation india, dedollarisation impact on india, dedollarisation news, dedollarisation impact, modi age, modi news, india kenya relations, india kenya mou, india africa relations, india africa summit

dedollarisation india, dedollarisation impact on india, dedollarisation news, dedollarisation impact, modi age, modi news, india kenya relations, india kenya mou, india africa relations, india africa summit

In Blow to USD, India & Kenya Back Development Project Financing in INR

11:56 06.12.2023 (Updated: 11:58 06.12.2023) India has taken policy measures to move away from the USD and switch to INR in trade settlements following the disruptions caused by Western sanctions against Moscow last year.

Indian Prime Minister Narendra Modi and Kenyan President William Ruto have directed the relevant agencies in their countries to work towards implementing development project financing between the two nations using the Indian rupee (INR).

A joint statement released after the summit-level talks between the two leaders in New Delhi on Tuesday stated that the decision was taken to boost the development partnership among the nations.

It underlined that New Delhi has agreed to increase its lines of credit (LOC) to Kenya to $250 million from previously $100 million.

The Indian credit lines will be deployed for the mechanization of agriculture projects in Kenya, in line with the national development priorities of the African state.

The joint statement also noted that Ruto expressed his gratitude to Prime Minister Modi for the India’s concessional credit lines in sectors such as energy and textiles as well as small and medium-size enterprises (SMEs).

Addressing a special press briefing in New Delhi, India’s Secretary (Economic Relations) at the Ministry of External Affairs (MEA),

Dammu Ravi, highlighted that Kenya was one of

India’s strongest developmental partners in Africa.

Ravi said that both the leaders discussed extending

cooperation in digital public infrastructure (DPI), including the use of India’s domestic digital payments system Unified Payments Interface (UPI).

He also highlighted that that Modi and Rutto discussed ways to expand cooperation in trade and investment.

Ravi noted that bilateral trade averaged around $3.3 billion. Around 200 Indian companies have investments worth nearly $3.3 billion in Kenya.

India’s Push to Switch from US Dollar to INR

In recent months, New Delhi and Nairobi have taken measures to promote the use of

national currencies in trade settlements, according to Indian government.

In fact, the Reserve Bank of India (RBI) has approved special rupee vostro accounts (SRVA) of 22 nations, including Kenya, to facilitate trade settlements in Indian rupees.

In March this year, India’s new Foreign Trade Policy (FTP) for 2023-28 time period called for encouraging trade in INR to shield Indian businesses from disruptions such as unilateral sanctions or economic crisis.