https://sputniknews.in/20251023/trumps-sanctions-unlikely-to-break-russia-india-china-energy-corridor-analyst-9962463.html

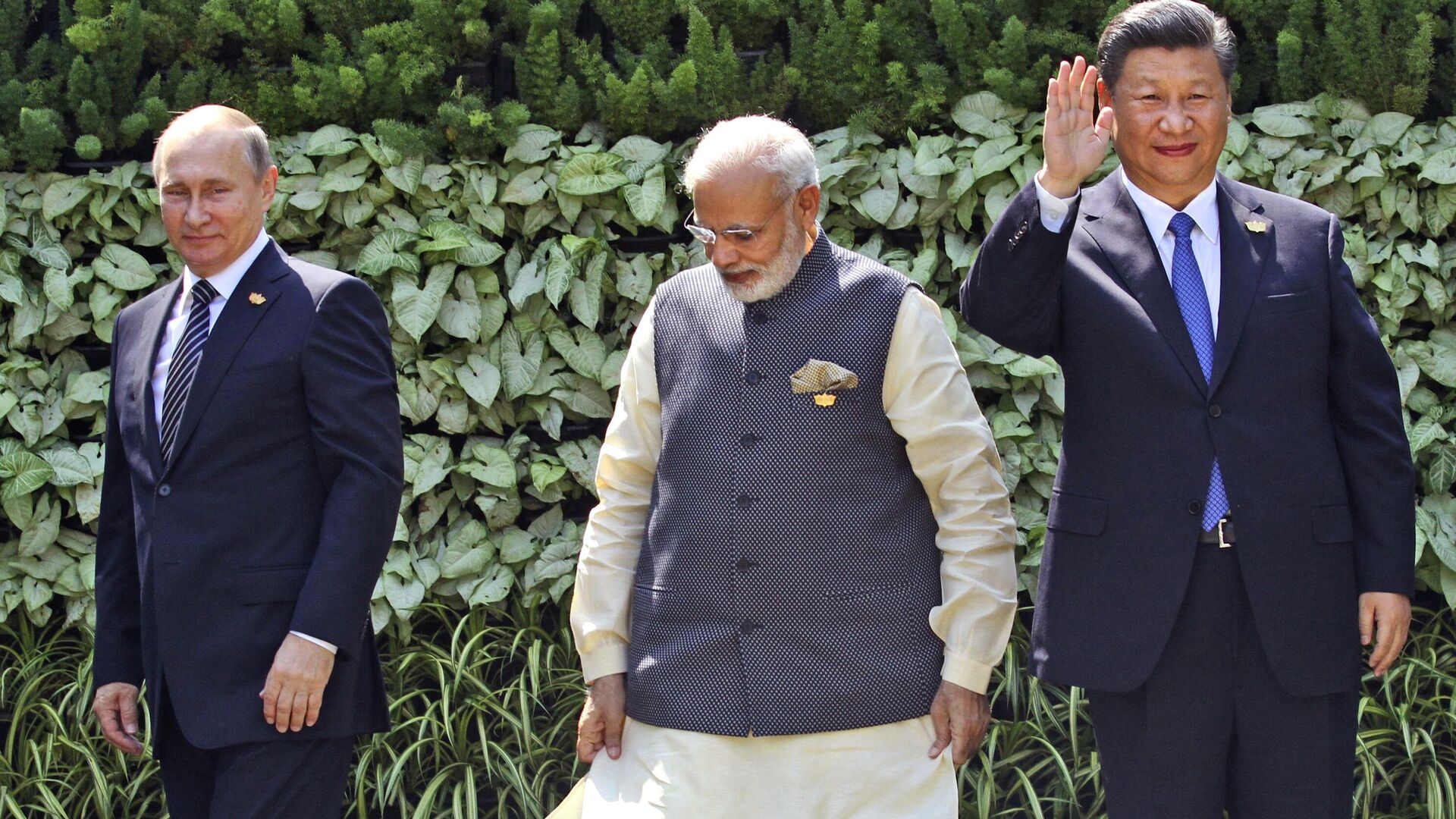

US Sanctions Unlikely to Break Russia-India-China Energy Corridor: Analyst

US Sanctions Unlikely to Break Russia-India-China Energy Corridor: Analyst

Sputnik India

The US Treasury on Wednesday designated Russian oil firms Rosneft and Lukoil, in what marks the first time that the Trump administration has sanctioned Russian entities since returning to power this year.

2025-10-23T19:35+0530

2025-10-23T19:35+0530

2025-10-23T19:37+0530

sputnik opinion

donald trump

india

china

russia

european union (eu)

rosneft

western sanctions

sanctions

energy security

https://cdn1.img.sputniknews.in/img/07e8/04/05/7048218_0:187:2976:1861_1920x0_80_0_0_dbab333501fa0b975daadb05a3ef37d1.jpg

While the latest US sanctions against Russian oil companies may cause “short-term caution” on part of Indian state and private refiners, they are unlikely to break the “Russia-India-China energy corridor”, an Indian geoeconomic analyst has told Sputnik India."Recalibration of Russian oil imports is ongoing and Reliance will be fully aligned to GOI (Government of India) guidelines," a Reliance spokesman was quoted as saying by several media outlets on Thursday.Sarma said that continued demand for affordable energy in India, the world's fastest growing major economy, would make it difficult for US' sanctions to bite deep.For Sarma, the latest US sanctions against Russian companies and their subsidiaries are more than just about aiding Ukraine.He said that the US sanctions, expected to kick in 21 November onwards, expose Washington’s tendency to “weaponise its financial dominance to distort global energy markets”.Sarma said that Trump may well be looking to increase the US share of energy exports to the Asian markets, which are being urged to “diversify” under the pretext of moral responsibility.Commenting on the 19th round of anti-Russia sanctions package announced by the European Union (EU) on Wednesday, Sarma cautioned that these would backfire for European economies by further driving up energy procurement costs and inflation.The sanctions now disrupt these indirect channels, Europe faces another spike in energy costs — even as Brent Crude index has already jumped nearly 5% to $65.65 per barrel following Trump’s announcement, he said

https://sputniknews.in/20251022/kpler-debunks-trumps-claims-on-indias-russian-oil-purchases-9954287.html

india

china

russia

ukraine

europe

eurasia

greater eurasia

turkiye

hungary

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2025

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

us sanctions against rosneft, rosneft sanctions, trump sanctions russian oil, trump tariffs russian oil, trump modi call, russian oil exports, russian oil exports to india, india russia news, india russia trade, india russia news, modi putin call, modi putin news, russian oil reliance

us sanctions against rosneft, rosneft sanctions, trump sanctions russian oil, trump tariffs russian oil, trump modi call, russian oil exports, russian oil exports to india, india russia news, india russia trade, india russia news, modi putin call, modi putin news, russian oil reliance

US Sanctions Unlikely to Break Russia-India-China Energy Corridor: Analyst

19:35 23.10.2025 (Updated: 19:37 23.10.2025) The US Treasury on Wednesday designated Russian oil firms Rosneft and Lukoil, in what marks the first time that the Trump administration has sanctioned Russian entities since returning to power this year.

While the latest US sanctions against Russian oil companies may cause “short-term caution” on part of Indian state and private refiners, they are unlikely to break the “Russia-India-China energy corridor”, an Indian geoeconomic analyst has told Sputnik India.

“Reports already suggest Indian refiners like Reliance Industries Limited (RIL) and state-run firms are reviewing documents to ensure imports aren’t directly linked to Rosneft or Lukoil — not that they’ll halt trade altogether,” stated Dr. Hriday Sarma, who’s previously been a Visiting Fellow at leading think-tanks such as the Institute for National Security Studies (INSS) and the Institute for Defence Studies and Analyses (MP-IDSA).

"Recalibration of Russian oil imports is ongoing and Reliance will be fully aligned to GOI (Government of India) guidelines," a Reliance spokesman was quoted as saying by several media outlets on Thursday.

Sarma said that

continued demand for affordable energy in India, the world's fastest growing major economy, would make it difficult for US' sanctions to bite deep.

“Instead, the restrictions may push Moscow, New Delhi, and Beijing toward more resilient payment systems — yuan or rupee settlements — and new logistics routes insulated from Western influence,” reckoned Sarma.

Further, he explained that American attempts to isolate Russia could instead “deepen Eurasian cooperation”, transforming Russian energy from a wartime necessity into a strategic asset powering regional partnership.

For Sarma, the latest US sanctions against Russian companies and their subsidiaries are more than just about aiding Ukraine.

“They reveal an energy-driven agenda aimed at pushing Asia’s largest consumers, India and China, away from discounted Russian crude and toward costlier Western alternatives,” the Indian analyst said.

He said that the US sanctions, expected to kick in 21 November onwards, expose Washington’s tendency to “weaponise its financial dominance to distort global energy markets”.

Sarma said that

Trump may well be looking to increase the US share of energy exports to the Asian markets, which are being urged to “diversify” under the pretext of moral responsibility.

“What is presented as a move to end the war in Ukraine conveniently serves Washington’s long-term goal — capturing markets once served by affordable Russian energy,” he explained, while noting how the U.S. has been quick to capture the European energy market by exporting its costly Liquefied Natural Gas (LNG) in the wake of Ukraine conflict.

Commenting on the 19th round of anti-Russia sanctions package announced by the European Union (EU) on Wednesday, Sarma cautioned that these would backfire for European economies by further driving up energy procurement costs and inflation.

“Several EU states, from Germany to Hungary, still rely on Russian-origin energy through intermediaries like India and Turkey,” the Indian analyst said.

The sanctions now disrupt these indirect channels, Europe faces another spike in energy costs — even as Brent Crude index has already jumped nearly 5% to $65.65 per barrel following Trump’s announcement, he said

“In essence, Washington’s measures risk punishing its own allies. While the US sells LNG at a premium and boosts domestic energy profits, Europe pays more for its moral alignment — a loyalty tax that strains both households and industries,” Sarma concluded.