https://sputniknews.in/20231208/g7-ban-on-russian-diamonds-puts-india--us-on-opposite-ends-5764071.html

G7 Ban on Russian Diamonds Puts India & US on Opposite Ends

G7 Ban on Russian Diamonds Puts India & US on Opposite Ends

Sputnik India

Differences have emerged between India and the G7 bloc over the upcoming import ban on Russian rough diamonds, which was announced after a virtual leaders’ meeting of rich countries this week.

2023-12-08T17:50+0530

2023-12-08T17:50+0530

2023-12-08T17:51+0530

business & economy

india

russia

us

alrosa

g7

russian diamonds

western sanctions

sanctions

european union (eu)

https://cdn1.img.sputniknews.in/img/07e7/08/1e/3943830_0:154:3007:1845_1920x0_80_0_0_67cdd46a226ad2c7a633af6be3de9b21.jpg

Differences have emerged between India and the G7 bloc over the upcoming import ban on Russian rough diamonds, which was announced after a virtual leaders’ meeting of rich countries this week.According to a G7 joint statement, the bloc would impose “import restrictions” on diamonds mined, processed or produced in Russia by 1 January, 2024, as well as enforce “phased restrictions” on import of Russian-origin diamonds processed in third nations by next March. The G7 also called for establishing a “robust traceability-based verification and certification mechanism for rough diamonds within the G7”. Further, the Indian industry association has raised concerns over the “powers” G7 will have in enforcing the diamond ban. Meanwhile, the reaction on the upcoming G7 ban from the Indian diamond trade workers has been more vocal. Tank stated that only “20 percent” of the diamond trade workshops and units in Surat have been operating as usual due to the economic downturn in the industry.He estimated that Surat had around 4,000-5,000 diamond trade workshops, with each of them employing between 10 (small units) to 10,000 workers. Surat is among the world’s biggest diamond processing hubs, with around 90 percent of the global rough diamonds imported to the city and polished here before being exported. Over 50 percent of the polished diamonds from India were exported to the US in 2021, according to official statistics. Why is India Worried About Russian Diamond Import Ban? Till this year, Russia’s diamond mining giant Alrosa has been a major supplier of rough diamonds to the Surat industry. In the January-August 2023 period, Russian rough diamond imports were worth around $885.72 million.Significantly, India’s rough diamond imports from the UAE stood at around $9.4 billion in 2022 and were worth nearly $6.1 billion in January-August 2023. The commerce ministry data showed that the US, Hong Kong and Belgium have been the biggest markets for polished diamonds from India. Edahn Golan, a global diamond industry analyst, told Sputnik India that the “impact” of western restrictions on Russian diamonds has been “limited” till now because of the fact that polished diamonds weren’t covered under the sanctions.He said that in spite of western restrictions, Alrosa has “remained firm” on pricing of its rough diamond exports. India Doesn’t Recognise Western SanctionsAshwani Mahajan, the co-convenor of economic advocacy group Swadesh Jagran Manch (SJM), told Sputnik India that New Delhi didn’t recognise “unilateral sanctions” by any country, which he highlighted has been a consistently policy of New Delhi. Since last year, New Delhi has emerged as a big importer of Russian crude, which has regularly traded above the G7 price cap. This year, Moscow has emerged as the biggest supplier of crude to India, a trend analysts predict would continue in coming months despite western pressure. He expressed confidence that India would continue to maintain a “neutral” approach on the issue, in line with its foreign policy.

https://sputniknews.in/20231208/india-not-happy-with-timeline-of-g7-ban-on-russian-diamonds---5754414.html

india

russia

us

europe

ukraine

gujarat

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

News

en_IN

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik India

feedback.hindi@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Dhairya Maheshwari

https://cdn1.img.sputniknews.in/img/07e6/0c/13/138962_0:0:641:640_100x100_80_0_0_2cb44360dbcdf6d84bf4b299cd045917.jpg

dubai diamond exchange, surat diamond industry, indian diamond industry, surat diamond association, india russia relations, russian diamonds, russian diamond news, russian diamond exports, russian diamond exports, russian diamond exports by country, indian diamond industry, indian diamonds, indian diamond industry, g7 ban on russian diamonds, g7 ban, g7 sanctions, western sanctions on russia

dubai diamond exchange, surat diamond industry, indian diamond industry, surat diamond association, india russia relations, russian diamonds, russian diamond news, russian diamond exports, russian diamond exports, russian diamond exports by country, indian diamond industry, indian diamonds, indian diamond industry, g7 ban on russian diamonds, g7 ban, g7 sanctions, western sanctions on russia

G7 Ban on Russian Diamonds Puts India & US on Opposite Ends

17:50 08.12.2023 (Updated: 17:51 08.12.2023) India has been reeling under the impact of US restrictions on Russian diamond imports. The situation in India could turn worse as G7 is set to introduce a Russian diamond ban next year.

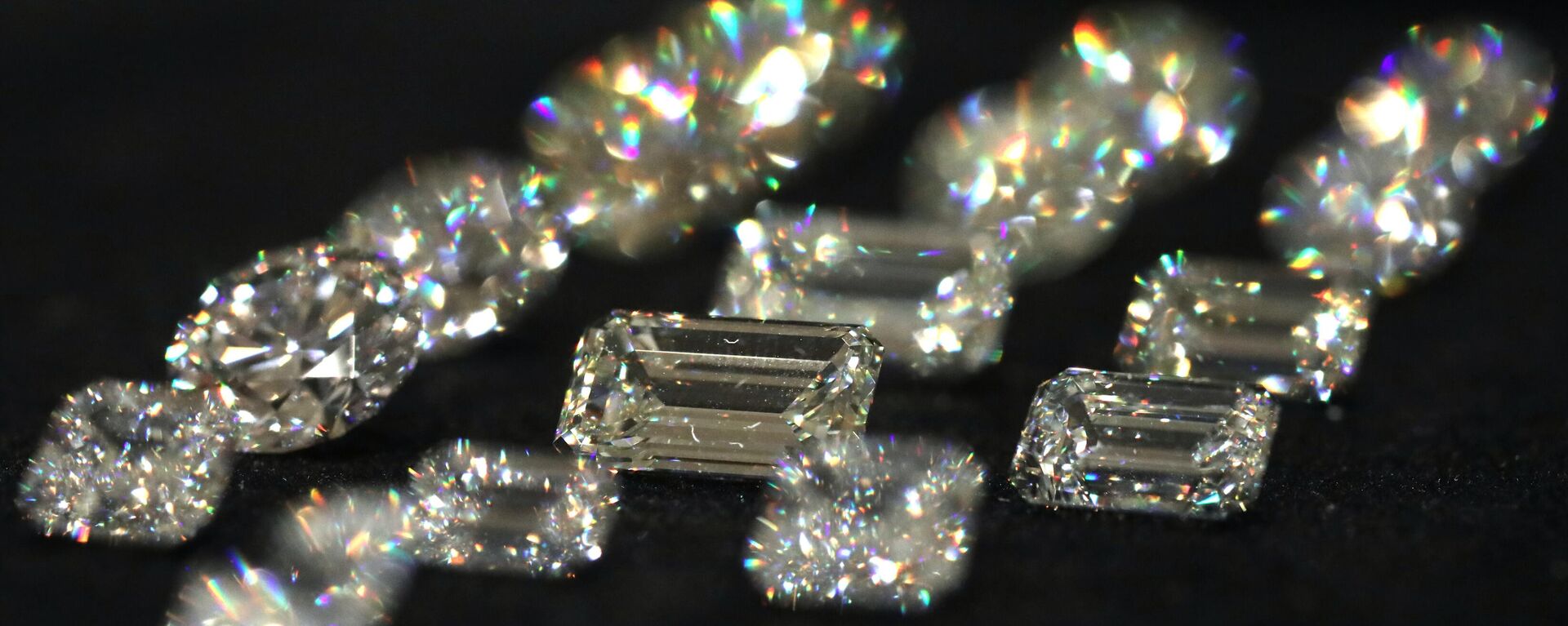

Differences have emerged between India and the G7 bloc over the upcoming import ban on Russian rough diamonds, which was announced after a virtual leaders’ meeting of rich countries this week.

According to a G7 joint statement, the bloc would impose “import restrictions” on diamonds mined, processed or produced in Russia by 1 January, 2024, as well as enforce “phased restrictions” on import of Russian-origin diamonds processed in third nations by next March.

The G7 also called for establishing a “robust traceability-based verification and certification mechanism for rough diamonds within the G7”.

The announcement has been met with concern in India. In a statement on Thursday, the Gems and Jewellery Promotion Export Council (GJEPC) expressed its displeasure with the timeline and urged for more “flexibility”.

Further, the Indian industry association has raised concerns over the “powers” G7 will have in enforcing the diamond ban.

Significantly, the GJEPC expressed confidence that the Indian government would help in protecting the interests of Indian workers assisting them in any way in view of G7 sanctions.

Meanwhile, the reaction on the upcoming G7 ban from the Indian

diamond trade workers has been more vocal.

“The diamond industry in Surat has already been reeling under recession-like conditions due to restrictions on

Russian rough diamond imports announced by the US this year. The

G7 ban could further worsen our situation,” Bhaveshbhai Tank, the vice-president of Diamond Worker Union Gujarat, told Sputnik India.

Tank stated that only “20 percent” of the diamond trade workshops and units in Surat have been operating as usual due to the economic downturn in the industry.

He estimated that Surat had around 4,000-5,000 diamond trade workshops, with each of them employing between 10 (small units) to 10,000 workers.

“Rough diamond imports from Russia have been important for the industry here. We have already appealed to the G7 representatives to lift their restrictions on Russian rough diamonds,” the workers’ union representative stated.

Surat is among the world’s biggest diamond processing hubs, with around 90 percent of the global rough diamonds imported to the city and polished here before being exported.

Over 50 percent of the polished diamonds from India were

exported to the US in 2021, according to official statistics.

Why is India Worried About Russian Diamond Import Ban?

Till this year, Russia’s diamond mining giant Alrosa has been a major supplier of rough diamonds to the Surat industry.

According to data by India’s Ministry of Commerce and Industry, rough diamond imports from Russia were worth nearly $1.1 billion in January-December 2022 period.

In the January-August 2023 period, Russian rough diamond imports were worth around $885.72 million.

Significantly, India’s rough diamond imports from the UAE stood at around $9.4 billion in 2022 and were worth nearly $6.1 billion in January-August 2023.

“The emergence of the UAE as a major source of rough diamonds in recent years indicates that Russian rough diamonds are possibly being routed into India through Dubai, which has become a major diamond trading hub. However, it is difficult to estimate how much of the diamond imported from the UAE is of Russian-origin and how much is from other sources,” Tank explained.

The commerce ministry data showed that the US, Hong Kong and Belgium have been the biggest markets for polished diamonds from India.

Edahn Golan, a global diamond industry analyst, told Sputnik India that the “impact” of western restrictions on Russian diamonds has been “limited” till now because of the fact that polished diamonds weren’t covered under the sanctions.

“That is going to change as some of the largest consumer markets intend to block them,” Golan forecasts, adding that this would result in increase in prices of rough as well as polished diamonds.

He said that in spite of western restrictions, Alrosa has

“remained firm” on pricing of its rough diamond exports.

“However, as sanctions roll in, demand for Russian goods is expected to be negatively impacted. This is expected to have a cooling effect on its pricing,” Golan opined.

India Doesn’t Recognise Western Sanctions

Ashwani Mahajan, the co-convenor of economic advocacy group Swadesh Jagran Manch (SJM), told Sputnik India that New Delhi

didn’t recognise “unilateral sanctions” by any country, which he highlighted has been a consistently policy of New Delhi.

“In spite of growing ties with the West, the Indian government would continue to do what is in our national interest and the best interest of our workers. We will have to look for ways to adapt to these sanctions in the same way we managed to overcome the restrictions placed on Russian oil imports by G7 in the form of a price cap,” Mahajan reckoned.

Since last year, New Delhi has emerged as a big importer of Russian crude, which has regularly traded above the G7 price cap.

This year, Moscow has emerged as the biggest supplier of crude to India, a trend analysts predict would continue in coming months despite

western pressure.

Mahajan suggested that India would continue to import rough diamonds from Russia in “limited quantities” and sell the polished stone to other markets such as Hong Kong.

He expressed confidence that India would continue to maintain a “neutral” approach on the issue, in line with its

foreign policy.

“We won’t stop importing Russian rough diamonds just because of external pressure. We have to maintain our friendly ties with Russia. At the same time, the US has the option whether to buy polished diamonds from India or not,” asserted Mahajan.